Stock

Master Market Entry with This RSI Strategy!

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the...

Read moreMarket Research and Analysis – Part 5: Drawdown Analysis

While the world of finance believes risk is measured by volatility (standard deviation), it is my belief that loss of...

Read more2023 Q4 Earnings Analysis and Projections Through 2024 Q4

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis.The following chart shows the normal value...

Read moreIs the Banking System on the Verge of Systemic Implosion? What to Look Out For

2024 will be marked by a massive string of bank failures!!! Well, according to a few economists on the far...

Read moreDespite Stable Markets, Breadth Says Danger

In this edition of StockCharts TV's The Final Bar, Dave drops a market update, with a focus on Bitcoin's rebound above 70K,...

Read more2 Consolidating Stocks Ready To Resume Their Uptrends

My preference is to trade strong stocks that are simply consolidating and ridding themselves of weak hands, hopefully just in...

Read moreWeek Ahead: NIFTY May Continue Finding Resistance At Higher Levels; These Sectors May Relatively Outperform

In the previous technical note, it was categorically mentioned that while the markets may attempt to inch higher, they may...

Read moreMEM TV: Is It Safe To Reenter The Markets?

In this episode of StockCharts TV's The MEM Edge, Mary Ellen shares what to be on the lookout for to tell if...

Read moreDouble Top Forming in Growth vs. Value?

In this edition of StockCharts TV's The Final Bar, Dave answers questions from The Final Bar Mailbag. Today he talks about how...

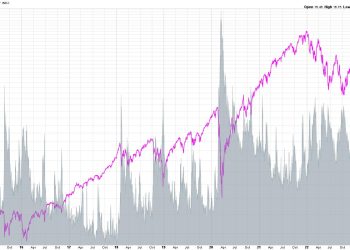

Read moreVIX Spikes Above 16 – Is This the End?

The VIX ended the week just above 16, bringing it to its highest level in 2024. What does this tell us...

Read more