The downward mood in the overall crypto market within the past 30 days saw AI-centered Render (RNDR) struggling.

The crypto recorded a significant activity dip within the derivatives market.

Render’s future open interest down 40%

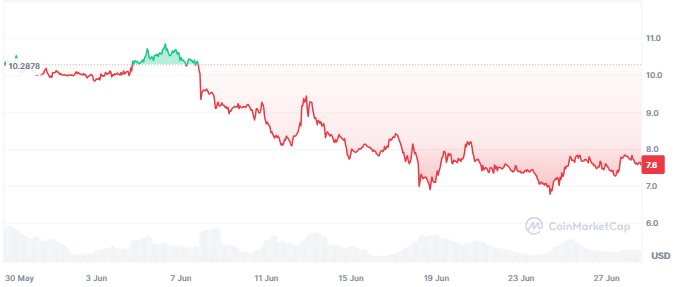

RNDR lost nearly 30% of its value in June as bears dominated the alt.

The downward price actions forced most traders to quit the futures market.

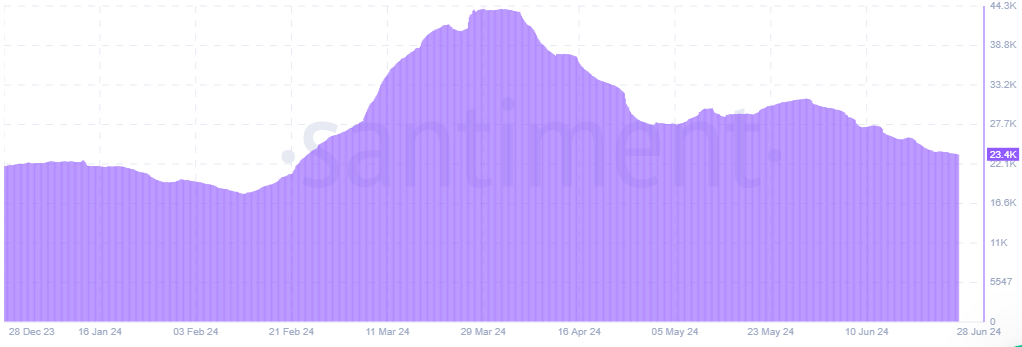

Render’s futures open interest displayed a massive 35% decline within the past 30 days.

The metric stood at $102.7 million during this publication, according to Coinalyze.

The futures open interest index measures the asset’s value of futures contracts awaiting closing or settlement.

A dip in open interest shows players are closing positions without executing new ones.

That translates to faded trader interest and market activity – a bearish sentiment in the financial space.

The reduced daily active wallets in the Render network confirm the declined interest and demand for the asset.

Addresses transacting RNDR daily have slumped by 11% within the past month.

Furthermore, the AI-backed crypto has seen reduced enthusiasm from new investors. New wallet creation plunged by 9% in June.

RNDR’s price outlook

While the abovementioned indicators signal weakness for the altcoin, Render appeared ready for upside moves.

RNDR painted its daily price chart green after a 1.21% increase, changing hands at $7.66 during this publication.

Sellers seem to lose momentum, suggesting a potential bounce back for Render prices.

The positive 24-hour trading volume underscores improved trader optimism in RNDR.

Increased bullish actions to reclaim the weekly support barrier at $7.93 would catalyze solid recovery.

Render can jump from the $7.93 foothold to test new peaks beyond $10.80 before eyeing another ATH.

Meanwhile, crypto analyst DOC Crypto trusts “Render remains an incredible buying opportunity around $7.”

The Aroon Indicator, reading 28.57% at press time, supports impending recovery for the AI token.

The Aroon signal measures the token’s trend momentum and possible price reversal areas.

A figure close to zero highlights a weak downtrend, and that the asset reached its most recent price. That signals a potential rebound.

Continued bullish price moves amid broad market revival will attract more traders to rescue Render from its downsides.

Positive developments like collaborating with Safe Software to streamline workflow set Render for long-term growth.

Moreover, the project’s AI-centric approach positions RNDR for solid performance in the upcoming times.

The post Render (RNDR) signals recovery despite future open interest hitting monthly lows appeared first on Invezz