Latest iteration of the Communications Service Provider (CSP) IoT Peer Benchmarking report from the world’s leading IoT analyst firm identifies the key trends shaping IoT connectivity and identifies the market leading MNOs and MVNOs.

Transforma Insights, the world’s leading Internet of Things analyst firm, has today published the 2024 edition of its ‘Communications Service Provider (CSP) IoT Peer Benchmarking Report’, identifying both the key themes that are defining the IoT connectivity market and the leading MNOs and MVNOs for IoT.

The report is based on extensive discussions with 25 leading global providers of cellular connectivity and detailed analysis of their capabilities and strategies. The CSPs profiled consist of: 1NCE, AT&T, BICS, Deutsche Telekom IoT, Emnify, Eseye, floLIVE, KORE, KPN, NTT, Ooredoo, Pelion, Semtech, Singtel, Soracom, T-Mobile US, Tele2, Telefónica, Telenor, Telia, Telit Cinterion, Velos IoT, Verizon, Vodafone and Wireless Logic.

Key trends in IoT connectivity

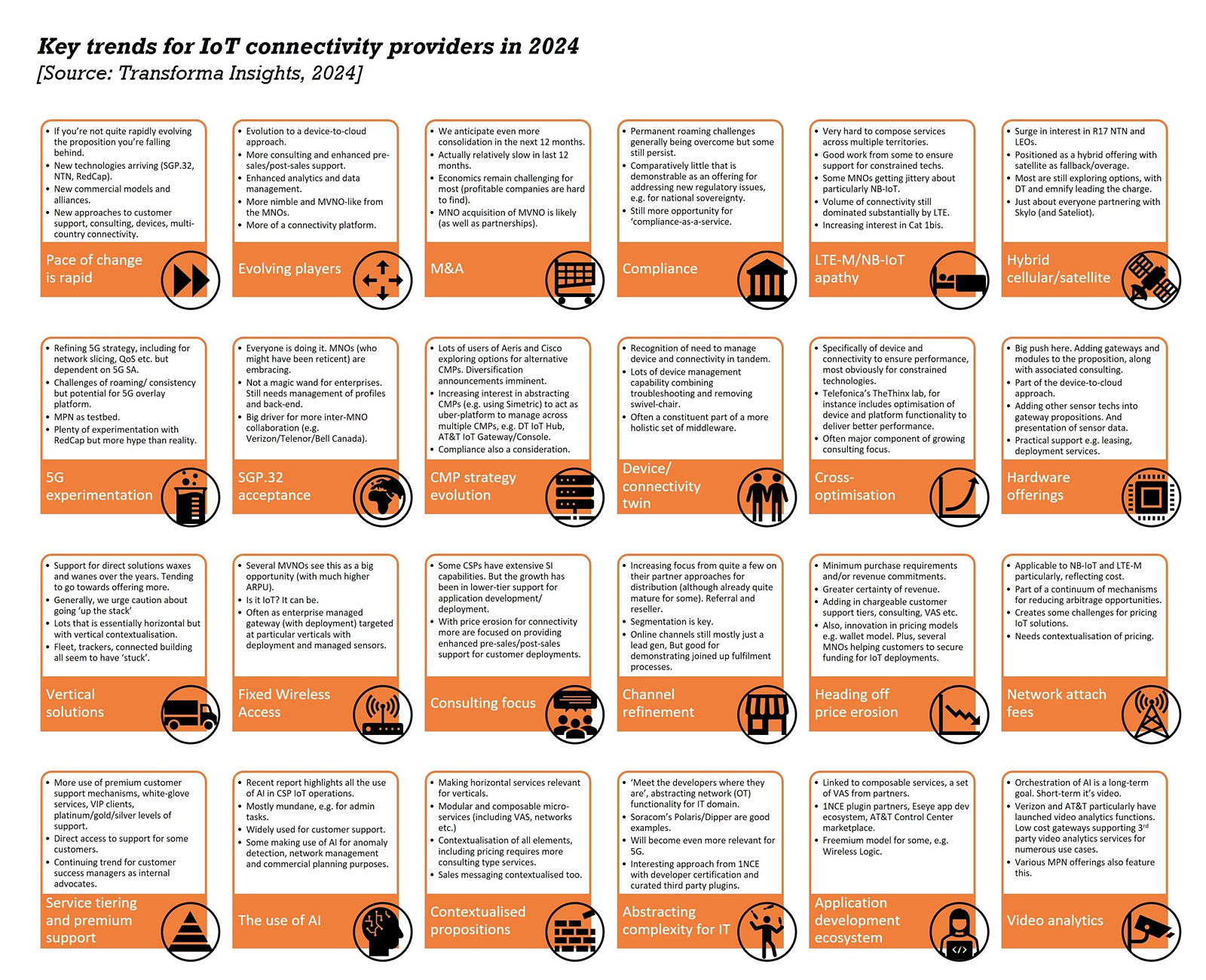

As a result of the extensive analysis, in addition to our ongoing research on IoT trends, we are able to draw a set of conclusions about how the IoT connectivity market, and specifically that related to cellular connectivity, has evolved since the last report was published in February 2023. The main key themes are:

- The pace of change continues to be rapid, with evolving approaches to the market and the arrival of new technologies and commercial models. We expect more disruption in the coming year.

- Devices and a device-to-cloud proposition, often incorporating sensors and data management, are becoming a key component of an IoT connectivity offering.

- The quest for additional chargeable services and new revenue streams continues, including through premium support, network attach fees, VAS, Fixed Wireless Access, devices and consulting.

- The need for customisation and contextualisation are paramount and require a modular and composable set of services plus some element of ‘consulting’.

- Compliance represents both a challenge and an opportunity. Permanent roaming issues are largely resolved but with new data sovereignty, national resilience and other regulations on the horizon.

- The Connectivity Management Platform landscape is evolving although at a relatively slow pace. There is appetite for change, both for CMP selection (typically dual-sourcing) and for overlay abstraction platforms.

- Composing a multi-country connectivity solution, particularly involving LTE-M/NB-IoT is still too hard. Piggybacking on non-IoT networks remains king, and the door is firmly open for LTE Cat 1bis.

- Despite the fact that the provision of connectivity using LPWA technologies leaves something to be desired, CSPs are still on the scout for the ‘next big thing’ with satellite NTN fulfilling that role at the moment. 5G does not yet promise much, although some forward-thinking CSPs are preparing.

- SGP.32 is a positive and represents a significant reduction in the complexity of supporting localised connectivity. It will drive new business models and approaches.

- There is innovative work focused on simplifying the process of adopting IoT connectivity, in particular in ‘meeting the developer were they are’ by translating the telecoms domain into IT.

These themes, and many more, are explored in greater detail in the report, as illustrated by the chart below.

Market leading CSPs for IoT

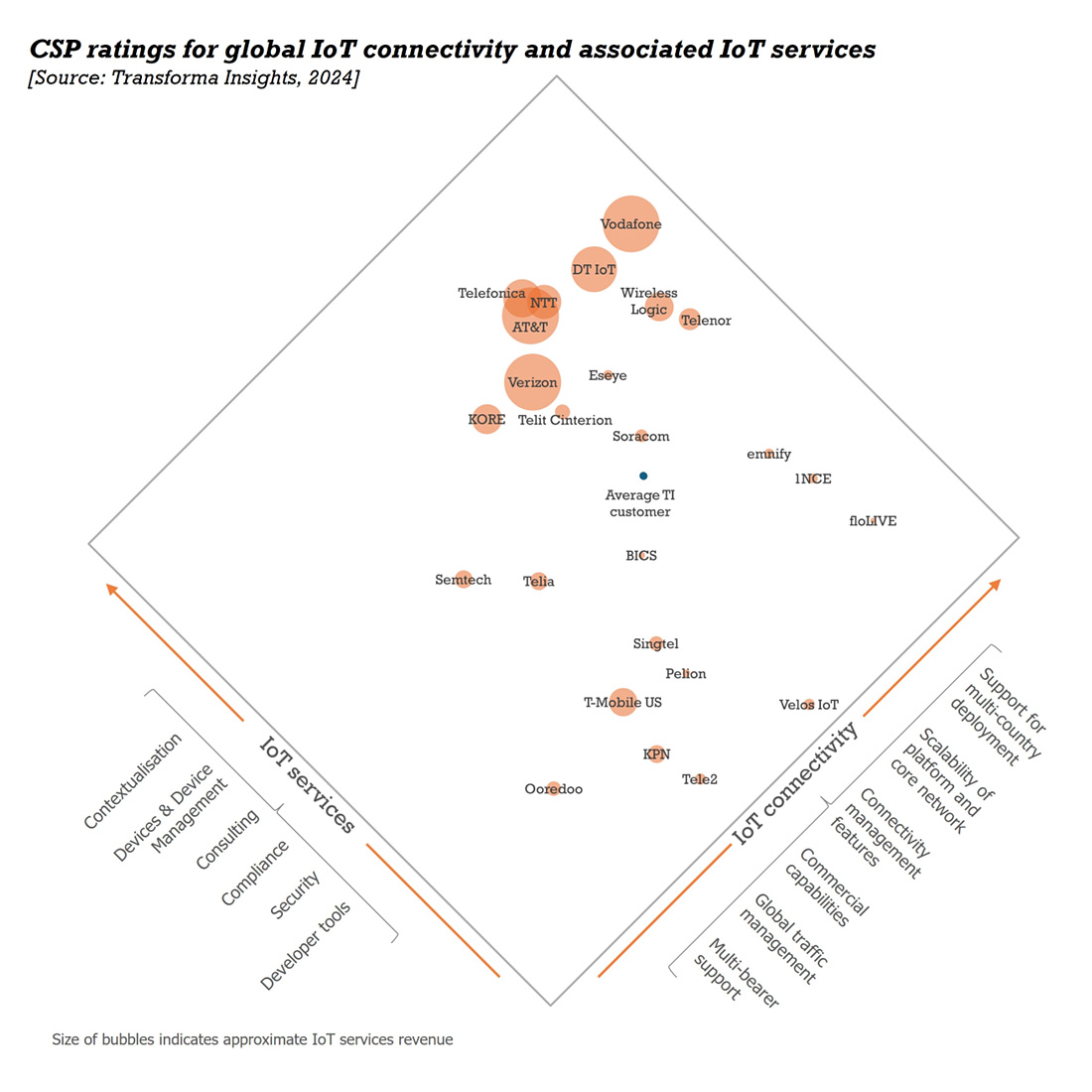

Based on the assessment of the CSPs’ strategies and capabilities we seek to advise enterprise adopters of which would be the most appropriate vendor to use for their IoT connectivity needs. The answer to that question is always specific to that organisation’s requirements, so there is no single ‘best’ CSP for IoT. Selection depends on innumerable factors, including the capabilities that the customer needs, the location of devices, preferred commercial models or even which cloud provider is used.

In the chart below we present our overall view of which are the market leaders. Our assessment has two dimensions. The first relates to pure IoT connectivity, including factors such as how multi-country connectivity is addressed, scalability, mechanisms for global traffic management and CMP capabilities. The second looks at those factors that are immediately adjacent to connectivity including devices, developer tools, security, compliance and contextualisation.

Report author Matt Hatton comments: “There are three main categories of leading CSPs for IoT. At the very apex of the diamond are the major mobile network operators, led by Vodafone and followed closely by DT IoT, NTT, Telefónica, AT&T and Verizon. The second category of market leaders are those that have focused exclusively on providing excellence in a narrow element of pure cellular connectivity, largely ignoring devices or much in terms of customisation for the enterprise client. This group includes 1NCE, emnify and floLIVE. Finally there is a group of CSPs that straddles the two camps, in some cases with equally capable connectivity offerings, but typically married with a more complete set of capabilities around ‘IoT services’. This group comprises Eseye, KORE, Soracom, Telenor, Telit Cinterion and Wireless Logic.”

Overall, the top 10 leaders in IoT connectivity are: Vodafone, Telenor, floLIVE, Wireless Logic, 1NCE, DT IoT, emnify, NTT, Eseye, and Telefonica. The top 10 leaders in IoT services are: Telefonica, AT&T, NTT, Vodafone, DT IoT, KORE, Verizon, Telit Cinterion, Eseye, and Wireless Logic. And the report notes an honourable mention for Soracom which just misses out on both of these lists, but has a strong proposition across both.

In the chart above, for the purposes of full transparency, we also include a dot to indicate the location of the average Transforma Insights client (i.e. any company with which we have had a commercial relationship in the last 12 months).

The post Transforma Insights identifies the key themes and market leaders in IoT connectivity appeared first on IoT Business News.