IoT Analytics, in its recently published IoT Mobile Operator Pricing and Market Report 2024–2030, has highlighted significant developments in the cellular IoT market.

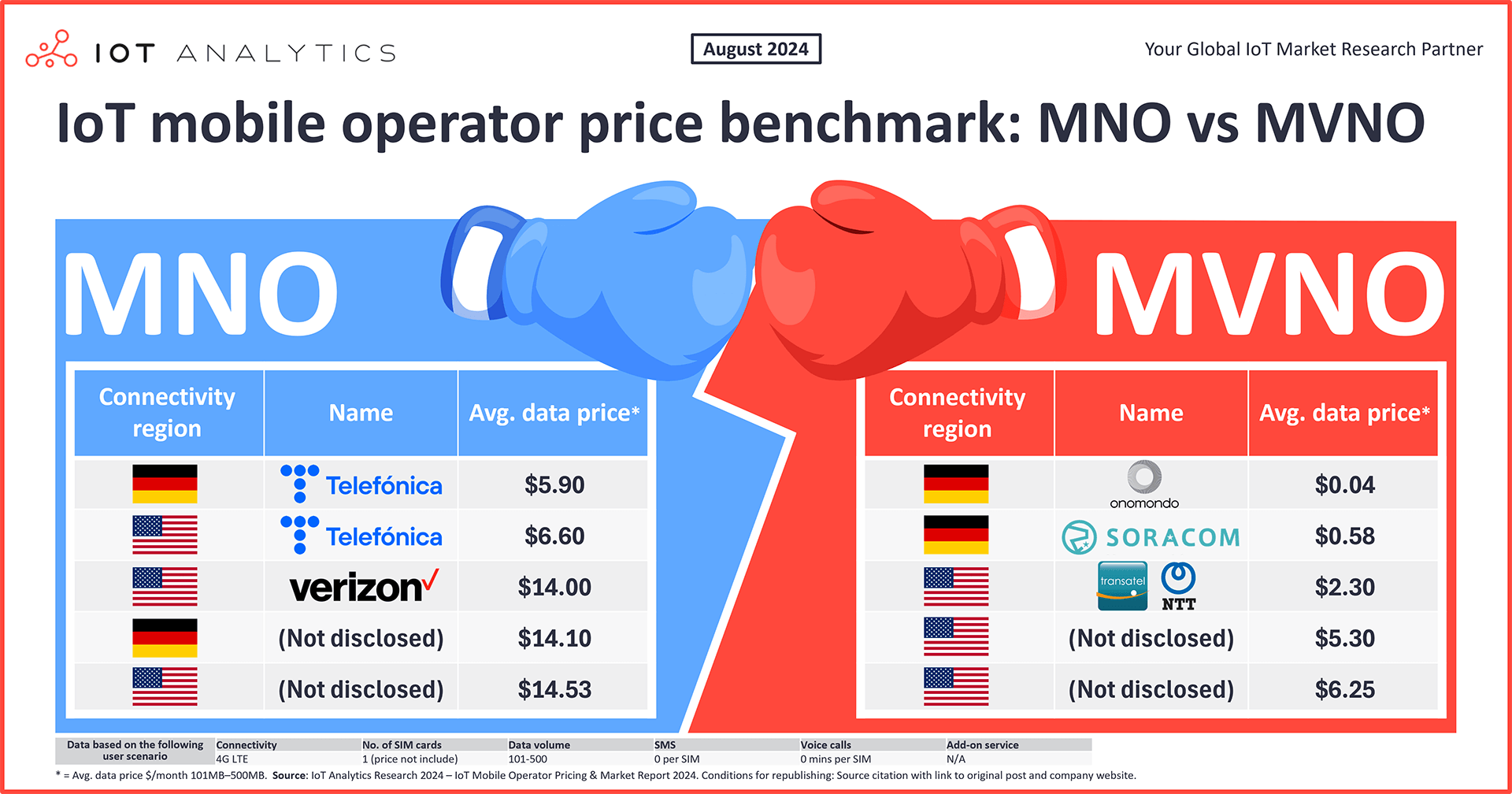

According to the 159-page report, there were 3.6 billion active cellular IoT connections in 2023, accounting for approximately 21% of global IoT connections. The accompanying extensive database further includes specific scenarios for a typical 4G connectivity end-user case. The findings reveal that Verizon (local MNO) and Transatel (MVNO) offer the most affordable services in the U.S., while Telefónica (MNO) and Onomondo (MVNO) provide the most cost-effective options in Germany for the same scenario. A benchmark of the two types shows that MVNO IoT services cost substantially less than MNO IoT services due to lower overhead, but MNOs remain competitive with value-added services and diverse offerings.

Key insights:

- There were 3.6 billion active cellular IoT connections in 2023, approximately 21% of global IoT connections, according to the IoT Mobile Operator Pricing and Market Report 2024–2030 and its accompanying mobile operator database.

- Two IoT mobile operator types provide cellular IoT connectivity: mobile network operators (MNOs) and mobile virtual network operators (MVNOs).

- A benchmark of the two types shows that MVNO IoT services cost substantially less than MNO IoT services due to lower overhead, but MNOs remain competitive with value-added services and diverse offerings.

- IoT Analytics put together an extensive database of IoT mobile operator pricing plans and picked 2 specific scenarios for a typical 4G connectivity end-user scenario, showing Verizon (local MNO) and Transatel (MVNO) having the cheapest service in the U.S., while Telefónica (MNO) and Onomondo (MVNO) are the cheapest in Germany for the same scenario.

Select quotes:

Satyajit Sinha, Principal Analyst at IoT Analytics, comments that “The integration of eSIM and iSIM technologies is poised to enhance MVNO competitiveness in the IoT connectivity landscape significantly. These advancements enable greater service plan flexibility and customization, potentially widening the competitive gap between MVNOs and MNOs. Additionally, MVNOs’ early adoption in sectors like automotive and their strategic pivot towards comprehensive IoT solutions could solidify their market position.”

Kalpesh Baviskar, Market Analyst at IoT Analytics, adds that “MNOs have traditionally focused on offering pure connectivity services as their primary strategy in the IoT sector. IoT connectivity revenues, where less data is consumed in a longer period, remain a relatively small portion of their overall earnings, especially when compared to revenues from mobile phone plans and FTTH (Fibre to the Home) services, where more data is consumed by devices in a shorter period. In contrast, MVNOs are well-positioned to thrive without being burdened by the capital expenditures associated with network infrastructure, nor the pressure to generate immediate revenue. This advantage allows MVNOs to explore other areas within the value chain, such as offering IoT connectivity platforms and global connectivity through eSIMs. As user preferences shift beyond basic connectivity towards comprehensive, vertical-specific solutions, MNOs are also shifting towards providing value-added services as enhancements to their data offering.”

Cellular IoT market overview

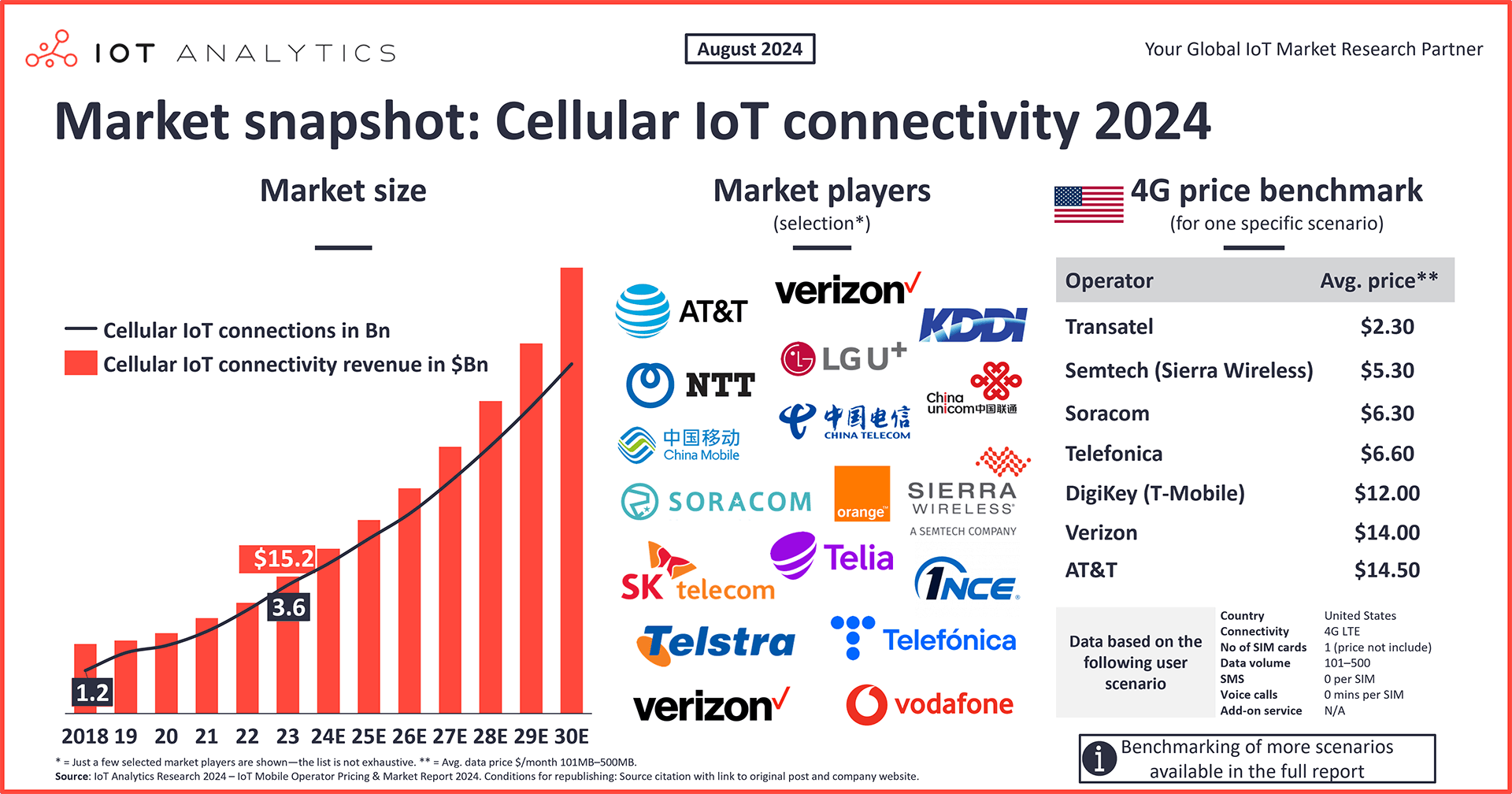

Cellular IoT connections surpassed 3 billion in 2023. According to the 159-page IoT Mobile Operator Pricing and Market Report 2024–2030 and its accompanying mobile operator database* (both published in July 2024), global active cellular IoT connections grew by 24% to 3.6 billion active connections in 2023. Global cellular IoT revenue doubled between 2018 and 2023 (from $7.7 billion to $15.2 billion) and is expected to reach $49 billion by 2030, reflecting a CAGR of 18%. IoT connectivity made up 1.3% of global mobile operator revenue in 2023, well behind other sources of revenue for most operators (e.g., paid mobile phone plans); however, this number is expected to rise to 3.2% by 2030.

Cellular IoT connectivity market landscape

2 IoT mobile operator types provide cellular IoT connectivity. The market is split between mobile network operators (MNOs) and mobile virtual network operators (MVNOs). These two mobile operator types provide cellular IoT connectivity services directly to end users and are the only type of network operators the report focuses on. MNOs provide the physical, licensed network infrastructure and offer services from this infrastructure. MVNOs leverage the license and capacity of the MNOs to offer their own services. As such, a share of the revenue for MVNOs’ IoT connectivity services contributes to the revenue of MNOs. For example, Japan-based MVNO Soracom—acquired by Japan-based telecommunications company NTT in 2019—leverages the network infrastructure of major US carriers, such as AT&T, Verizon, and T-Mobile, for its cellular IoT services in the US.

Benchmarking IoT mobile operators: MNOs vs MVNOs

End-user preferences vary. Some end-users see IoT connectivity as a commodity and seek the most budget-friendly services. Others have additional requirements, such as high data limits with data pooling services, lower latency, and management of large-scale IoT deployments, and thus seek tailored services, making the decision more complex.

Based on the IoT mobile operator database, a benchmark of MNOs and MVNOs is below, highlighting the benefits and offerings that make them competitive in the cellular IoT market.

MVNOs offer substantially lower prices on average. The analysis in the IoT Mobile Operator Pricing and Market Report compared 150 IoT data plans from over 20 mobile operators worldwide (all of which can be found in the report’s accompanying database). Using 4G LTE as the connectivity standard and 101–500 MB of data band for reference, on average, mobile operators offer ~32% cheaper pricing than MNOs. For example, when comparing standard data-only plans, the average monthly cost per SIM for MNOs worldwide was $7.30, while the average cost for MVNOs worldwide was $4.98, a difference of 32%.

How MVNOs offer lower prices for IoT connectivity

Lower overhead aids in MVNOs’ lower prices. MVNOs operate on MNOs’ network infrastructure, which itself incurs capital expenditure (CAPEX) for MNOs to build and maintain. MNOs recover the costs associated with building and maintaining through higher plan prices, but since MNVOs do not have to build and maintain such infrastructure, they do not incur these costs. This much lower overhead allows MVNOs to keep their margins—and thus their prices—low. In the UK, several MVNOs, such as VOXI, Asda Mobile, Lebara, and Talkmobile, operate on UK-based MNO Vodafone‘s network infrastructure.

MVNOs often have modest offerings. MVNO IoT service offerings tend to provide more barebone options than MNO plans—lower data limits or fewer data options, for example. While this helps keep costs down for the subscriber, it can also be limiting depending on their needs, such as those needing higher data limits or more flexible data options. For instance, as shown in the IoT mobile operator database, Japan-based MVNO Soracom and US-based MVNO Semtech (Formerly Sierra Wireless) typically offer plans with around 1 GB of data or less, which may satisfy the needs of subscribers with low data needs but may not be enough for others.

How MNOs remain competitive at higher IoT service prices

MNOs offer better-tailored services. For subscribers who need more data, more flexible data limit options, faster speeds, or higher prioritization, MNOs can tailor IoT connectivity plans to fit those needs since they own the network infrastructure and capacity. MNOs can offer tiered service levels to match the needs of their subscribers, from high performance and data to lower, more budget-friendly packages. Examples of tiered data service levels are Spain-based MNO Telefónica, offering a Business High IoT plan with up to 500GB in the EU, and Australia-based MNO Telstra, offering plans between 100GB and 1TB of data.

MNOs offer value-added services. To sweeten their IoT service plans, many MNOs have strategically shifted their focus from providing pure connectivity services only to providing more end-to-end solutions by collaborating with hardware players, chipmakers, or software vendors. For example, China Mobile—the world’s top IoT mobile operator by connection and revenue—offers a one-stop solution strategy encompassing hardware components like chips, operating systems, and modules. The strategy also integrates with three of China Mobile’s IoT platforms—OneLink, OneNET, and OneCyber—and targets three main areas of application: video-based IoT, urban IoT, and industrial IoT. Meanwhile, Germany-based MNO Deutsche Telekom offers IoT detection solutions, which provide high visibility of the IoT devices roaming in foreign networks and allow operators to estimate the revenues and costs.

MNOs decide data traffic prioritization. While MVNOs operate on MNOs’ excess network capacity (meaning they pay lower prices for that capacity), MNOs may hold the right to prioritize their subscribers’ data over that of the MVNO subscribers. For instance, T-Mobile US prioritizes data for customers on most T-Mobile branded plans before the data of customers on Metro by T-Mobile plans or Assurance Wireless-branded plans, which are virtual wireless service providers owned by T-Mobile US.

Overview of IoT mobile operator pricing models and billing parameters

IoT mobile operators leverage 3 main pricing models and 15 main billing parameters. Cellular IoT price plans differ between IoT mobile operators, as they are often structured on pricing models and billing parameters. In terms of pricing models, there are generally 3 models that mobile operators may offer:

- Time-based – Subscribers pay a set fee for a pre-allocated data limit regardless of whether they used all their allotments.

- Usage-based – Subscribers pay a variable fee based on the amount of data consumed.

- Time + usage-based – Subscribers pay a fixed, recurring fee for a pre-allocated data limit, with additional charges for data usage beyond the pre-allocated limit.

For billing parameters, the report identifies 15 that operators may use to determine the cost and contract terms for subscriptions, including billing cycle, data speed, SIM service charges, and add-on services.

IoT pricing benchmarks

With 7 different cellular technologies in focus, 170 different countries, and 15 different billing parameters—each with different tiers—there are countless potential pricing combinations. The IoT mobile operator database contains 150+ data plans and allows for customized benchmarking. Below, MNOs and MVNOs are compared in a specific scenario where one IoT device consumes 100 MB per month on 4G LTE data with no additional data pooling and no additional devices.

US benchmark

The cheapest MVNO is 84% cheaper than the cheapest local MNO in the US. In the scenario above, the lowest base rate for a local MNO is $14 per month per SIM from Verizon. Meanwhile, for MVNOs, Transatel and Soracom offer the cheapest base rates of $2.30 per month and $4.40 per month, respectively. Of note, Telefónica USA is the most affordable MNO at $6.60, but it does not own any infrastructure in the US and relies on roaming agreements with local MNOs.

- Further about Verizon’s IoT data plan: Verizon uses a time-based billing model and offers a triple-punch SIM card—meaning the SIM can be reduced to smaller form factors (2FF, 3FF, and 4FF) to fit devices as needed—for $1.50 per SIM, which is ideal for scalability.

- Further about Soracom’s IoT data plan: Soracom leverages US-based MNO AT&T’s network for its IoT connectivity. It uses the time + usage-based pricing model and charges an additional overage fee of $1.50 per MB when the first 100 MB is reached. SIM cards are included.

- Further about Transatel’s IoT data plan: Transatel leverages Japan-based MNO NTT’s infrastructure for its core network and offers IoT connectivity. It uses the time-based pricing model but also offers usage-based pricing with an additional fixed fee of $1.80 per active SIM as connection charges (SIM cards are included). It allows customers to use a single SIM for both private network needs and global roaming. There is also a commitment to keep the SIM active for a 12-month period.

Germany benchmark

The cheapest MVNO is 83% cheaper than the cheapest MNO in Germany. In the same scenario, Spain-based MNO Telefónica offers the lowest base rate at $4.40 per month per device. Meanwhile, Denmark-based Onomondo offers a per-MB rate of $0.004 and includes a monthly fee of $0.33 for every activated SIM. For 100 MB of data, this comes to $0.73 per month per SIM.

- Further about Telefónica’s IoT data plan: Telefónica uses a time + usage-based pricing model and charges an additional $0.08 per MB over the base 100 MB. It offers standard SIM cards (2FF, 3FF, and 4FF) costing $2.19 per SIM and offers 2FF SIM cards for industrial applications for $3.29 per SIM.

- Further about Onomondo’s IoT data plan: Onomondo offers a usage-based pricing plan with no additional SIM card costs. The company also does not charge a monthly fee for SIM activation. All SIMs are delivered activated and are only charged when data is transmitted. The company offers standard SIM and industrial SIM cards with form factors such as 2FF, 3FF, and 4FF, as well as embedded SIM (eSIM) and SoftSIM. Currently, the SoftSIM only supports the nRF91 series cellular IoT module from Nordic Semiconductors and the LTE Cat-1 module from Quectel.

The post Benchmarking IoT mobile operator pricing: MNOs vs. MVNOs appeared first on IoT Business News.