When I look back at leading industry groups for the past day, week, month, 3-month, 6-month, and 1-year periods, only one industry group has been among the Top 20 industry groups for each of those 6 different periods. It’s a group that I liked heading into 2024 and it’s a group that I still like in 2025.

Banks ($DJUSBK).

If you take a look at how banks have kicked off earnings season, then it probably makes a lot of sense why they’re so in favor. Let’s look at the bigger banks that reported quarterly earnings since Wednesday:

- JP Morgan Chase (JPM): 4.81 vs. 4.03 (actual vs. estimate)

- Wells Fargo (WFC): 1.42 vs. 1.34

- Citigroup (C): 1.34 vs. 1.25

- Bank of America (BAC): .82 vs. .77

- PNC Financial (PNC): 3.77 vs. 3.30

- US Bancorp (USB): 1.07 vs. 1.06

- M&T Bank (MTB): 3.92 vs. 3.70

- First Horizon (FHN): .43 vs. .38

- Truist Financial (TFC): .91 vs. .87

- Huntington Bancshares (HBAN): .34 vs. .31

- Regions Financial (RF): .59 vs. .55

- Citizens Financial Group (CFG): .85 vs. .83

That’s the 12 largest banks that reported quarterly earnings last week and every single one of them beat EPS expectations, but JPM did so by a MILE! This is what happens when the yield curve uninverts and the net interest margin widens for banks. I’ve said on many occasions that this is the group that will benefit immensely from an improving economy and a lower fed funds rate.

Here are the charts for banks ($DJUSBK) and the bellwether JPM:

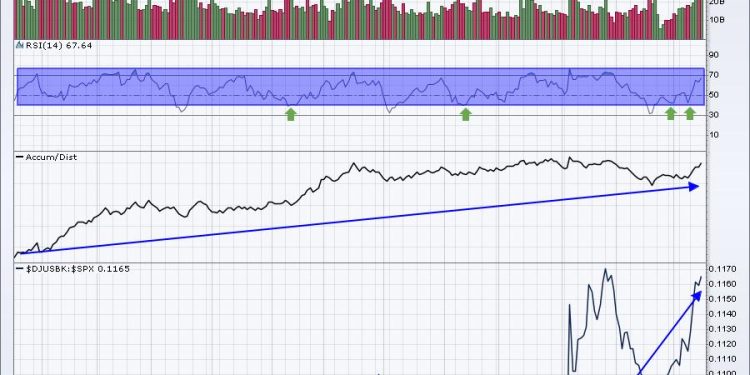

Banks:

The most telling part of the story on this chart is told in the bottom 2 panels. Once the long-term yield began to turn higher vs. the short-term yield, banks began to significantly outperform the benchmark S&P 500 in anticipation of the strong earnings that you can see above the chart. And it just makes common sense as the net interest margin for banks can only go up with this type of interest rate environment. That’s the fundamental side, which is certainly important. However, more important are the charts, and this one remains in a very bullish pattern. Currently, we appear to have the right side of a potential cup forming. The PPO is coming off a centerline test and is gaining bullish price momentum. The AD line is back near its 52-week high. I see banks going higher from here, though we do need to see price break out above the high from late November to confirm. Our primary indicator, the combination of price action and volume, suggests trend continuation.

JPM:

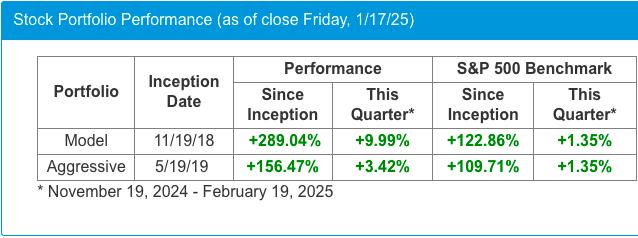

This is the PERFECT example of a stock that we like to own. JPM has gained 59.57% over the past year and it’s clearly a leading stock in a leading industry group. This is the key element that powers our portfolios – lining portfolios with leaders. We started our Model Portfolio on November 19, 2018, in the midst of the trade war and a cyclical bear market. 6 months later, we started our Aggressive Portfolio on May 19, 2019. Check out our stellar performance, especially vs. the benchmark S&P 500:

The Model Portfolio’s 289% advance vs. the S&P 500’s 123% advance. That’s crazy and when you consider what we’ve had to navigate these last 6+ years, it’s even crazier! We’ve endured the 2018 trade war and resulting cyclical bear market, the 2020 pandemic and resulting cyclical bear market, and the 2022 cyclical bear market, along with the worst inflation since the 1980s. That’s 3 bear markets, each falling 20% or more, in just over 6 years. No one consistently outperforms the benchmark S&P 500 like this, unless you follow our time-tested portfolio strategies. They don’t outperform every quarter (who does?), but these 6-year results speak for themselves.

Q4 Earnings

Earnings drive our portfolios. A company will never be included in our portfolios UNLESS it beats its latest quarterly revenue and EPS estimates. This isn’t a preference, it’s a MUST.

Earnings last week were, in most cases, WAAAAAY ahead of consensus estimates. Bank stocks have kicked this earnings season off in a very bullish way. But there’s another group, and you won’t believe which group it is, that is setting up to deliver BLOWOUT quarterly results, most likely better than banks. I’ll give you the group and one of its key stocks in our Tuesday EB Digest newsletter. I believe this elite company is set to report revenues and earnings way above current expectations. If you’re not already a FREE EB Digest subscriber, simply CLICK HERE, enter your name and email address, and join the tens of thousands of traders/investors around the globe! Make a difference in your trading in 2025!

Happy trading!

Tom