The trading week started with investors worried about tariffs, but the 30-day delay of tariffs on imports from Canada and Mexico shook off those worries. The three broad stock market indexes — S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU) — closed higher. Then came the retaliation on US tariffs from China, but that didn’t do much damage to the market.

The trading week started with investors worried about tariffs, but the 30-day delay of tariffs on imports from Canada and Mexico shook off those worries. The three broad stock market indexes — S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU) — closed higher. Then came the retaliation on US tariffs from China, but that didn’t do much damage to the market.

Let’s face it; the stock market is headline-driven at the moment. Based on the news, investors may favor healthcare stocks one day and tech stocks the next. For individual investors, playing the sector musical chair game makes for a difficult investment environment. So, instead of getting caught up in catching the right sector at the right time, it’s best to focus on the big picture and look at the longer-term trends and patterns. One way to do this is to examine the performance of different sectors, industry groups, and indices through the Bullish Percent Index (BPI).

StockCharts Tip: If you haven’t done so, download the Essentials ChartPack (Charts & Tools tab > ChartPacks). The Market & Index Bullish Percent Indexes list has seven charts in the ChartList (see below).

StockCharts Tip: If you haven’t done so, download the Essentials ChartPack (Charts & Tools tab > ChartPacks). The Market & Index Bullish Percent Indexes list has seven charts in the ChartList (see below).

FIGURE 1. DOWNLOADING CHARTPACKS. From the Charts & Tools tab, select ChartPacks to download the Essentials ChartPack.Image source: StockCharts.com. For educational purposes.

You could add more charts to the list. For example, I use a BPI ChartList each day to determine which sectors are bullish, overbought, or oversold. The image below displays some of the charts in my BPI ChartList.

FIGURE 2. VIEWING THE BULLISH PERCENT INDEX (BPI) CHARTLIST. The Summary view helps to see which sectors are bullish, bearish, overbought, or oversold.Image source: StockCharts.com. For educational purposes.

Viewing the ChartList in the Summary view helps to identify if the BPI is bullish, bearish, overbought, or oversold. You can also identify which sectors had the biggest changes for the day.

In the above image, the S&P Financial Sector BPI was the only one above 70, and Consumer Staples Sector BPI or $BPSTAP (not visible in the image; you’ll have to scroll to the next page) was the only one below 30.

Which Sectors Are Feeling the Love?

On Wednesday, the Predefined Alerts panel flashed that the Consumer Staples Sector BPI crossed above 30. This was a bull alert trigger warranting a closer look.

The chart below displays $BPSTAP with the Consumer Staples Select Sector SPDR ETF (XLP).

FIGURE 3. CONSUMER STAPLES BPI VS. CONSUMER STAPLES SELECT SPDR ETF (XLP). The BPI for the Consumer Staples Sector has crossed above 30, which is a bull alert trigger. The XLP chart still has to confirm a bullish move.Chart source: StockCharts.com. For educational purposes.

Although the $BPSTAP has crossed above 30, the XLP chart doesn’t display a bullish trend. Given that inflation is a big concern among US consumers, it’s worth monitoring the Consumer Staples sector for a chance to buy some stocks.

We posted an article on three stocks in the Consumer Staples sector, focused on Walmart, Inc. (WMT), Costco Wholesale Corp. (COST), and Sprouts Farmers Market (SFM). These stocks are still looking strong, but come with a high price tag. So, instead of purchasing the stock outright, I decided to explore options strategies for these stocks.

Options To the Rescue

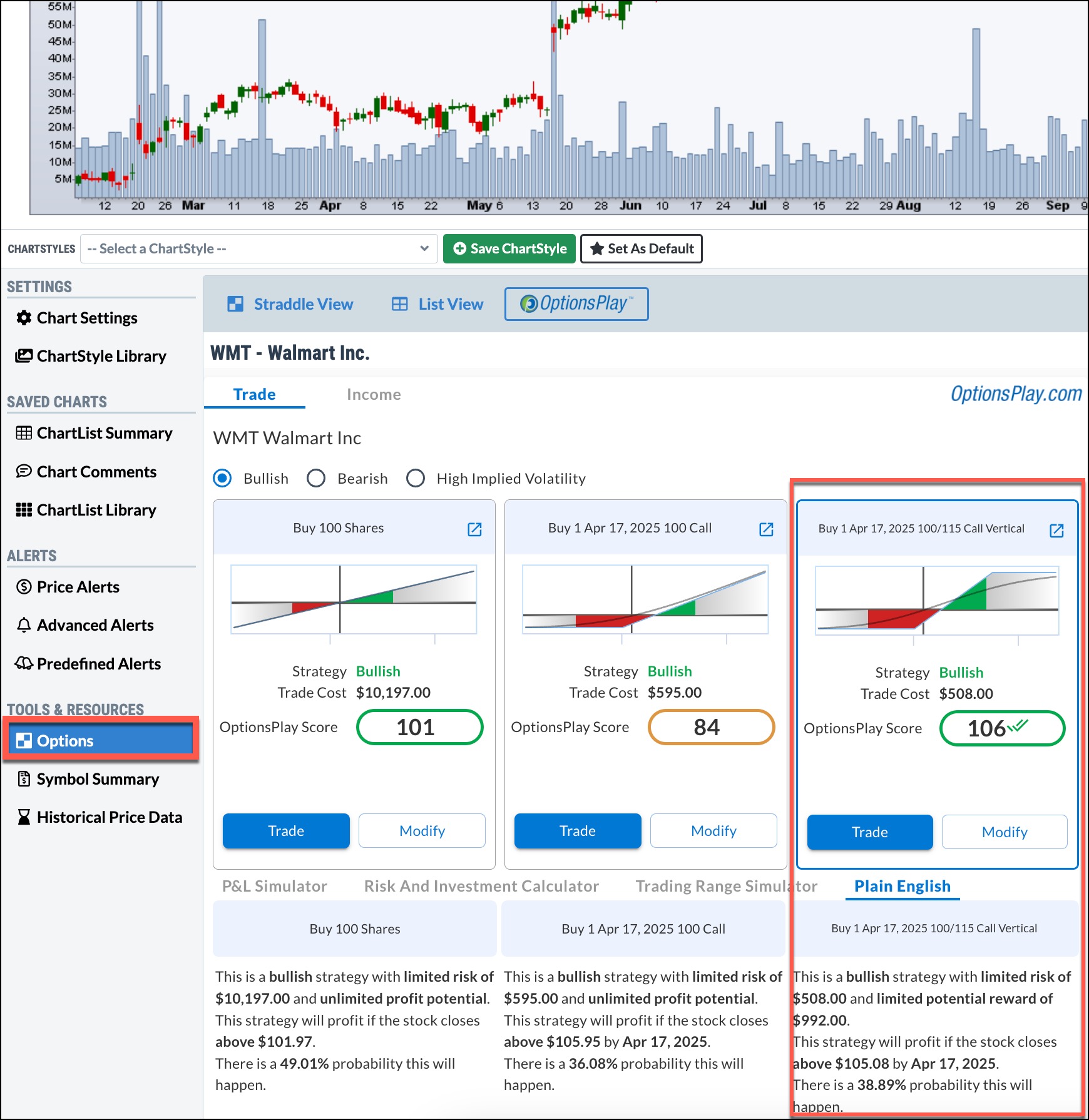

After analyzing all three stocks using the Options tool (see image below), I considered a call vertical spread on COST and WMT. SFM wasn’t under consideration since it had a low-scoring strategy.

- COST had an OptionsPlay score of 108. The call vertical trade would cost me $4,250 with an 182.35% potential return.

- WMT had an OptionsPlay score of 106. The trade would cost me $508 with a 172.05% potential return.

WMT was the lower-risk play, so I placed the April 17 100/115 call vertical, a strategy displayed in the OptionsPlay Explorer tool, with my broker (see image below). I got filled at a price slightly higher than $508 due to price fluctuations and broker fees.

FIGURE 4. OPTIONSPLAY EXPLORER DISPLAYS THREE OPTIMAL TRADES FOR WMT. The April 17 100/115 call vertical was the most optimal trade with a good risk/reward tradeoff. Image source: OptionsPlay Add-on at StockCharts.com. For educational purposes.

Closing Position

There are 71 days till expiry. If WMT closes above $105.08 the trade will be profitable. The target price is $113.82.

There’s a 38.89% probability of the stock closing above $105.08 by expiration, all else equal. I’ll monitor the position and, if the price target is reached, I will close my position. Another point to keep in mind is that WMT reports earnings on February 20 before the market opens. Volatility will likely increase around that time and could significantly move the stock price in either direction.