On Wednesday, the Federal Reserve released minutes from its January 28–29 meeting. There weren’t any surprises — the Fed wants to see inflation go lower before cutting interest rates again and would also like to see the impact of the new administration’s policies before making interest rate cut decisions. The takeaway: We won’t see rate cuts in the next Fed meeting.

The broader equity indexes rose after the Fed minutes were released, with the S&P 500 ($SPX) closing at a record high — that’s two consecutive record-high closes. The upside moves may not have been big spikes, but they were enough to show that investor sentiment is bullish and market breadth is improving. Bond prices also rose slightly.

Sector Strength

The Bullish Percent Index, an amazing indicator that gives you an indication of the internal health of an index or sector, displayed significant gains for several indexes and sectors. The S&P Industrials Sector BPI ($BPINDY) and the S&P Technology Sector BPI ($BPINFO) gained over 5%, the S&P Healthcare Sector BPI ($BPHEAL) gained over 3.50%, and the Nasdaq 100 BPI ($BPNDX) gained almost 3%.

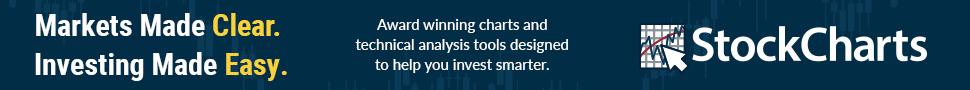

Let’s look at the charts of the Industrials BPI and Technology BPI. The chart of the Industrials BPI (see below) shows that it has just crossed over the 50 level, an indication the sector is gaining bullish strength. The daily chart of the Industrial Select Sector SPDR Fund (XLI), a proxy for the Industrial sector, is still trading sideways and its 50-day simple moving average (SMA) is still trending lower (see chart below). However, if the BPI of the sector rises higher, there could be an upside move in this sector.

FIGURE 1. DAILY CHART OF THE S&P INDUSTRIALS SECTOR BPI AND INDUSTRIAL SELECT SECTOR SPDR ETF. The bullish move isn’t evident in the chart of XLI but if $BPINDY continues to rise, XLI could move toward its all-time high. Chart source: StockCharts.com. For educational purposes.

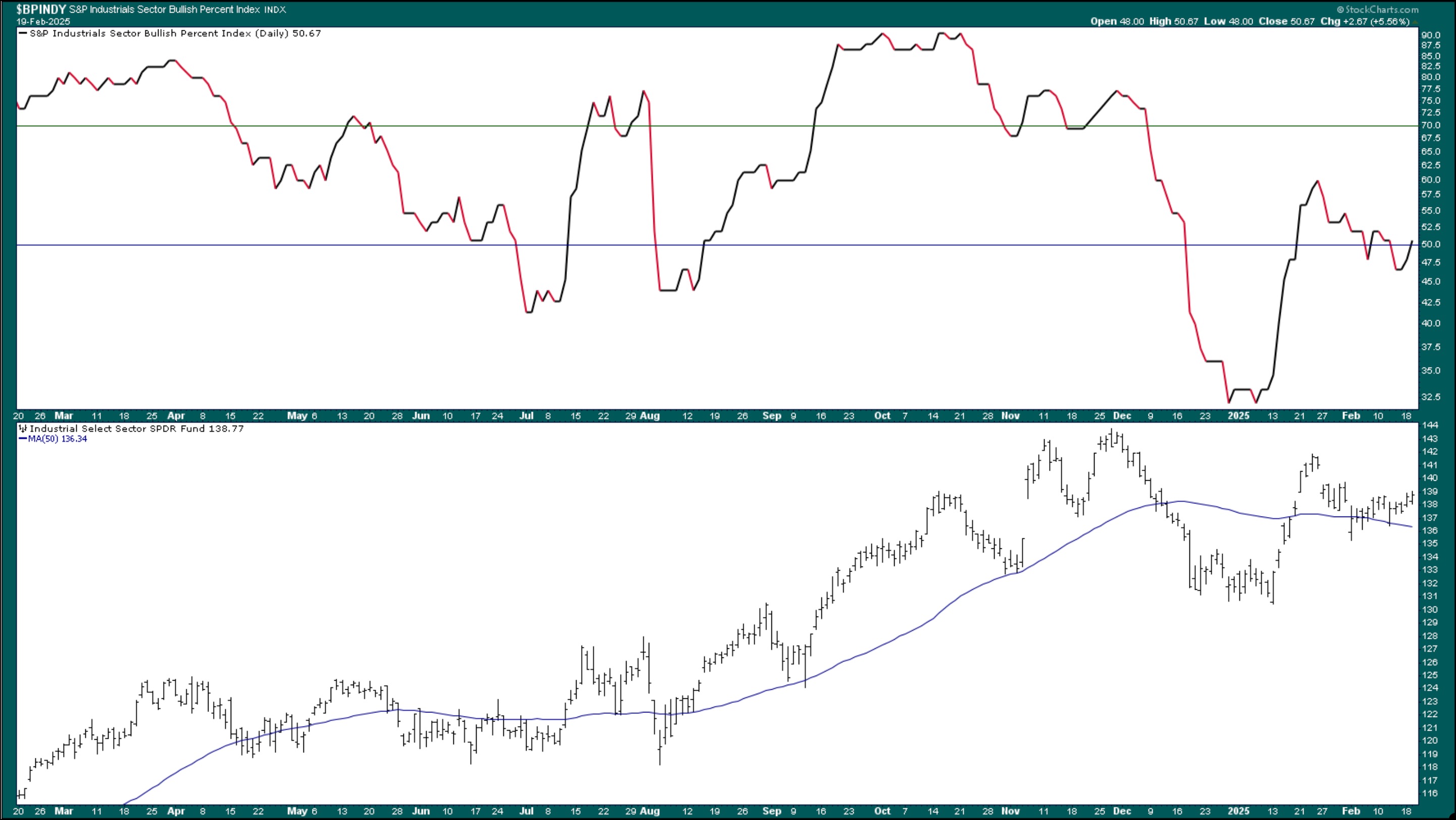

Shifting to the daily chart of $BPINFO, it’s clear that BPI is above 60, indicating bulls are in control in this sector. The Technology Select Sector SPDR ETF (XLK) is at its all-time high, which could be toppy. A break above this level would be bullish for the Tech sector.

FIGURE 2. DAILY CHART OF $BPINFO. The Technology sector is more bullish than the Industrials, but it could be getting toppy. A break above prevailing levels could mean the Tech sector still has legs. Chart source: StockCharts.com. For educational purposes.

Market Participation

Overall, there looks to be broader participation in the stock market. The S&P 500 Equal Weighted Index ($SPXEW) is moving higher (see chart below) but is battling against a resistance level (green line). A break above its current level clears the path for the index to reach its 52-week high.

FIGURE 3. DAILY CHART OF THE S&P 500 EQUAL WEIGHTED INDEX. The index is moving higher but has hit resistance. A break above this resistance level would confirm broader market participation. Chart source: StockCharts.com. For educational purposes.

FIGURE 3. DAILY CHART OF THE S&P 500 EQUAL WEIGHTED INDEX. The index is moving higher but has hit resistance. A break above this resistance level would confirm broader market participation. Chart source: StockCharts.com. For educational purposes.

Closing Position

Despite the uncertainty surrounding the stock market, the markets are leaning to the bullish side. We’re seeing upside movement in other asset classes besides the Mag 7 stocks. Monitor the BPI of various indexes and sectors. The simplest way is to follow these steps:

- Download the Essentials ChartPack.

- The US Sectors – Bullish Percent Indexes ChartList contains the BPI of all the sectors.

- The Market & Index Bullish Percent Indexes ChartList contains BPIs of various indexes.

- The US Industries – Bullish Percent Indexes ChartList contains charts of two indexes.

- You can modify these ChartLists by adding/deleting symbols.

- Monitor your ChartLists regularly.