The International Energy Agency has lowered its estimate for growth in global oil demand for 2025 as escalating trade tensions have affected the economic outlook.

“While imports of oil, gas and refined products were given exemptions from the tariffs announced by the United States, concerns that the measures could stoke inflation, slow economic growth and intensify trade disputes weighed on oil prices,” the Paris-based energy watchdog said in its April Oil Market Report.

Oil demand forecasts

The agency in its report lowered its forecast for growth in global oil demand in 2025 by 300,000 barrels per day to 730,000 barrels per day.

Growth is expected to slow further in 2026, to 690 kb/d, but risks to the forecasts remain rife given the fast-moving macro backdrop.

The substantial increase in oil consumption during the first quarter of 2025, which was up by 1.2 million barrels per day year-over-year and represented the strongest growth rate since 2023, directly preceded the downgrade, the agency said.

Furthermore, the IEA also said that for the remainder of the year, the growth in global oil demand has been reduced by 400,000 barrels per day.

The agency added that next year, demand growth in oil will be affected as electric vehicles will take up a larger share.

The reduction in forecasts for growth in global oil demand follows a similar move by the Organization of the Petroleum Exporting Countries on Monday.

OPEC had reduced its estimate for growth in global oil demand by just 150,000 barrels per day in 2025, citing the impact of US tariffs.

The cartel sees demand rising by 1.3 million barrels per day this year.

However, the IEA’s cut on Tuesday was more drastic.

Moreover, OPEC’s oil demand outlook is more optimistic than other industry forecasts, as it anticipates continued growth in oil consumption for years to come.

This contrasts with the IEA’s prediction that oil demand will peak this decade due to a global shift towards cleaner energy sources.

Supply forecasts

The IEA has also cut its estimate for growth in global oil supply by 260,000 barrels per day to 1.2 million barrels a day in 2025.

The decrease in the estimate for supply growth was attributed to lower output in the US and Venezuela.

Oil production in 2026 is set to rise by 960,000 barrels per day, with offshore projects taking the lead.

In March, the agency said global oil production rose by 590,000 barrels per day to 103.6 million barrels a day.

Supply in March was higher by 910,000 barrels per day compared with the same period last year, with non-OPEC+ supply growth leading in both monthly and annual gains.

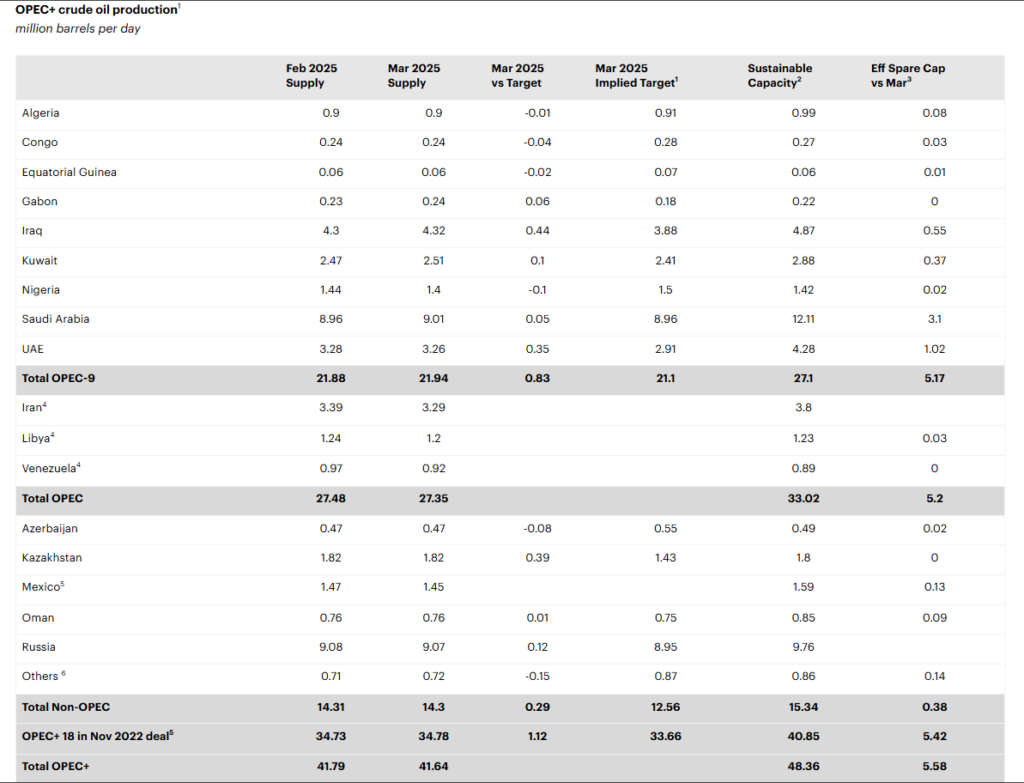

The May output target for OPEC+ will increase by 411,000 barrels per day as the cartel unwinds its voluntary production cuts of 2.2 million barrels a day.

IEA said:

However, the actual increase may be much smaller, as a number of countries, including Kazakhstan, the United Arab Emirates and Iraq are already producing well above their targets.

The Tengiz oilfield expansion project, operated by Chevron, has boosted Kazakh crude oil production to a record-breaking 1.8 million barrels per day, according to the IEA.

This puts Kazakhstan some 390,000 barrels a day above its OPEC+ output quota.

US production impacted

The Dallas Fed Energy Survey revealed that US shale companies require an average of $65 per barrel to profitably drill new light tight oil wells, making the sharp decline in oil prices a cause for concern.

“New tariffs may also make it more expensive to buy steel and equipment, further discouraging drilling,” the IEA said.

“Along with the impact of Chinese tariffs on imports of US ethane and LPG, this has resulted in a downward revision of 150 kb/d to our US oil supply forecast for this year, with growth now assessed at 490 kb/d,” IEA said.

The total non-OPEC+ supply is anticipated to increase by 1.3 mb/d, and conventional oil projects remain on schedule, according to the energy agency.

With arduous trade negotiations expected to take place during the coming 90-day reprieve on tariffs and possibly beyond, oil markets are in for a bumpy ride and considerable uncertainties hang over our forecasts for this year and next.

The post IEA joins OPEC in trimming oil demand forecast amid trade strains appeared first on Invezz