The cellular IoT module market shows signs of recovery

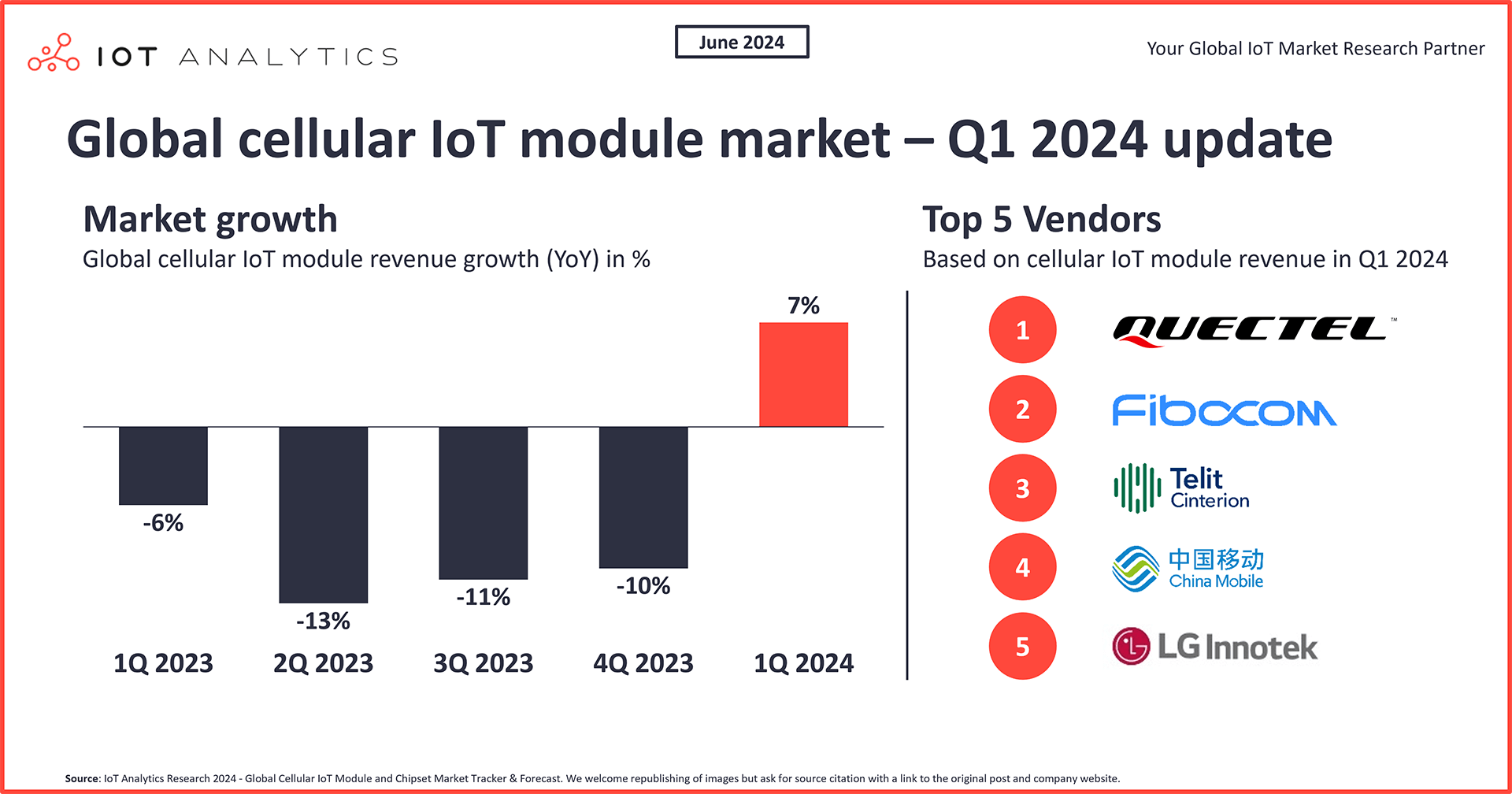

According to IoT Analytics’ Global Cellular IoT Module and Chipset Market Tracker & Forecast (updated early June 2024), which shares quarterly granular revenue and shipment data regarding IoT modules and chipsets across industry verticals and regions for cellular IoT deployments, the cellular IoT module market grew by 7% year-over-year (YoY) in Q1 2024. This growth is driven by an upswing in module demand in China.

Key insights:

- In Q1 2024, the cellular IoT module market grew 7% year-over-year, according to IoT Analytics’ latest Global Cellular IoT Module and Chipset Tracker & Forecast update.

- Driving this growth was an upswing in module demand in China, which counterbalanced the remaining inventory and demand issues in much of the world.

- Connectivity technologies like 5G and LTE Cat-1 bis experienced a combined 67% market growth year-over-year, contributing to the overall cellular IoT module market growth.

- Cellular IoT modules witnessed the strongest growth in the embedded automotive and both fixed and mobile access points sectors.

- The top 5 companies by module shipments — Quectel, Fibocom, Telit Cinterion, China Mobile, and LG Innotek — account for 60% of the global market in 2023.

Select quotes:

Satyajit Sinha, Principal Analyst at IoT Analytics, comments that:

“The cellular IoT module market is recovering, driven by demand from China. Despite this, the overall market stability remains weak, with continued declines in other regions. Our analysis suggests that the cellular IoT module market will experience a broader recovery outside of China in the latter half of 2024. Additionally, 5G and LTE-Cat 1 bis will play a key role in the global recovery of the cellular IoT module market in 2024.”

Cellular IoT module market overview

The cellular IoT module market shows signs of recovery. According to IoT Analytics’ Global Cellular IoT Module and Chipset Market Tracker & Forecast (updated early June 2024), which shares quarterly granular revenue and shipment data regarding IoT modules and chipsets across industry verticals and regions for cellular IoT deployments, the cellular IoT module market grew by 7% year-over-year (YoY) in Q1 2024.

Demand from China, 5G, and LTE Cat 1 bis contributed to this market upswing. Renewed demand for cellular IoT modules, primarily in China, drove this recovery in Q1 2024; however, much of the world continued to execute low-inventory strategies to prevent overstocking chips. Meanwhile, two technologies continued to contribute to market revenue growth and further aid in the market upswing: 5G and LTE Cat 1 bis.

Renewed demand for cellular IoT modules lowers inventories and drives shipments. In June 2023, IoT Analytics reported a decline in the cellular IoT module market due to device manufacturers adopting low-inventory strategies to avoid overstocking and minimize excess costs, reducing demand for these modules. This decline continued throughout 2023. However, according to the tracker, there was a recovery in demand in Q1 2024, driven primarily by China, where device manufacturers have largely depleted their existing inventories, prompting a renewed need for cellular IoT modules.

Global market heavily influenced by developments in China. To demonstrate China’s influence on the cellular IoT module market, the market tracker treats it as separate from the other Asia-Pacific countries. China accounts for 54% of the market, representing the largest revenue share, and its 23% revenue growth in Q1 2024 was enough to swing overall market revenue back into positive territory.

Recent Chinese market commentary from IoT module vendors

“The main reason for the growth is that the market conditions in this period are improving, the number of contracts signed for wireless communication modules and engineering services has increased, the order delivery volume has increased, and the revenue has increased.” – SUNSEA, Q1 2024 financial report (translated)

IoT module market outside China declined in Q1. Outside of China, the cellular IoT module market experienced a continued decline in revenue in Q1 2024 at a -6% YoY. North America and Europe were the only regions that experienced (single-digit) growth, while most other areas experienced double-digit revenue declines YoY. However, there are positive signs for these regions. Based on the market tracker, expectations are set for a broader recovery in demand for cellular IoT modules in the upcoming quarters.

Recent market commentary from non-Chinese IoT module vendors

“The results achieved in the first quarter of 2024 were weak as expected. Our view for 2024 is unchanged: based on our experience and input from customers, we expect a sequential recovery over the next quarters.” – u-blox, press release regarding Q1 2024 financial results, April 24, 2024

Technology market trends: 5G and LTE Cat 1 bis on the rise

5G is on track for the highest revenue gain in 2024. According to the market tracker, 2024 started with 5G holding the highest share of the overall cellular IoT module market by revenue. The increased shipments of 5G modules also resulted in the largest revenue boost, and revenue for 5G modules is forecasted to grow 61% in 2024. This highlights the expanding reach and adoption of 5G technology across various sectors like automotive, industrial automation, and smart cities.

Double-digit growth expected for LTE Cat 1 bis. Though only 6% of the cellular IoT module market in Q1 2024 was LTE Cat 1 bis based, it is the best-selling cellular IoT module type in China. LTE Cat 1 bis experienced the steepest climb in shipments in YoY, and the market forecasts a continued upward trend in this regard, resulting in 14% revenue growth in 2024. The demand for this technology is particularly notable in applications where ultra-high-speed connectivity is not essential, like point-of-sale terminals, smart meters, vehicle telematics units, and asset-tracking devices. It offers a balanced, efficient, and sufficient performance for many IoT and mobile applications.

“The overall market for Cat 1 bis modules has grown, and the price gap between NB IoT and Cat 1 bis modules is insignificant.” – Chinese module vendor during IoT Analytics’ research interviews in Q1 2024

Segment market trends: Embedded automotive and access points sectors drove 5G’s growth

The embedded automotive market segment leads in the use of cellular IoT modules. Embedded automotive held 22% market share in Q1 2024 and predominately leveraged 5G technology. The trackerforecasts that cellular IoT modules used in this segment will see an overall 14% revenue bump in 2024, driven mainly by applications of these modules in telematics and vehicle tracking, vehicle-to-everything (V2X) communication, advanced driver assistance systems (ADAS), and in-vehicle infotainment systems.

Access points (fixed and mobile) expected to contribute significantly to cellular IoT module revenue growth. According to the cellular IoT module market tracker,the access point segmentheld 14% market share in Q1 2024. This segment encompasses applications for smart buildings such as factories, transportation and logistics, public Wi-Fi, and high-definition content delivery. The cellular IoT modules used in these applications are predicted to see an overall revenue boost of 55% in 2024.

Recent market segment commentary on from IoT module vendors

“The three major areas, intelligent connected vehicles, fixed wireless access (FWA), and IoT, are all showing a recovery trend in demand, with FWA and IoT experiencing stronger demand from overseas customers.” – Meig, Q1 2024 financial report (translation)

Cellular IoT module competitive landscape: The top 5 companies

The top five cellular IoT module companies (based on revenue)—Quectel, Fibocom (including Rolling Wireless), Telit Cinterion, China Mobile, and LG Innotek—account for 60% of the global cellular IoT module market in revenue.

Here are additional insights about these top 5 module vendors:

-

1. Quectel: As the revenue leader with a 31% market share, Quectel experienced a 19% YoY growth in cellular IoT module revenue in Q1 2024.

2. Fibocom: Fibocom holds the #2 position with 10% market share. It experienced a 10% increase in revenue in Q1 2024 YoY, mainly due to strong sales of its advanced 5G cellular IoT modules.

3. Telit Cinterion: Telit Cinterion holds the #3 position in cellular IoT module revenue with 7% market share, though it is the only one of the top 5 that experienced a decline in its cellular IoT module revenue in Q1 2024, down 23% YoY. The company was founded in early 2023 as a result of the merger between Telit and Thales’s IoT module unit.

4. China Mobile: With 6% market share, China Mobile holds the #4 position. It experienced 70% cellular IoT module revenue growth in Q1 2024 YoY, mainly due to its 5G and Cat 1 bis modules. China Mobile sells its modules at a lower price than its competitors, giving it an advantage in the market.

5. LG Innotek: As a pure automotive communication module provider, LG Innotek holds the #5 position with a 5% share of global cellular IoT revenue.

Market outlook

Renewed demand outside of China on the horizon. Chinese cellular IoT module vendors are expected to maintain leadership in global market recovery into the second half of 2024. Additionally, Western companies are forecasted to increase shipments due to a resurgence in demand.

5G RedCap shipments starting soon. RedCap technology is set to enhance existing use cases such as wireless industrial sensors, video surveillance, smart grids, and smart wearables by enabling lower latency and improved energy efficiency. Currently, the operators are testing 5G RedCap networks and module shipments expected to begin in the 2nd half of 2024; however, only a few module vendors have developed or even launched 5G RedCap modules at this point.

Monitoring the speed of the recovery. The recovery of the cellular IoT module market shows how dynamic this market can be.

The post Cellular IoT module market Q1 2024 update: Demand recovery, market trends, and competitive landscape appeared first on IoT Business News.