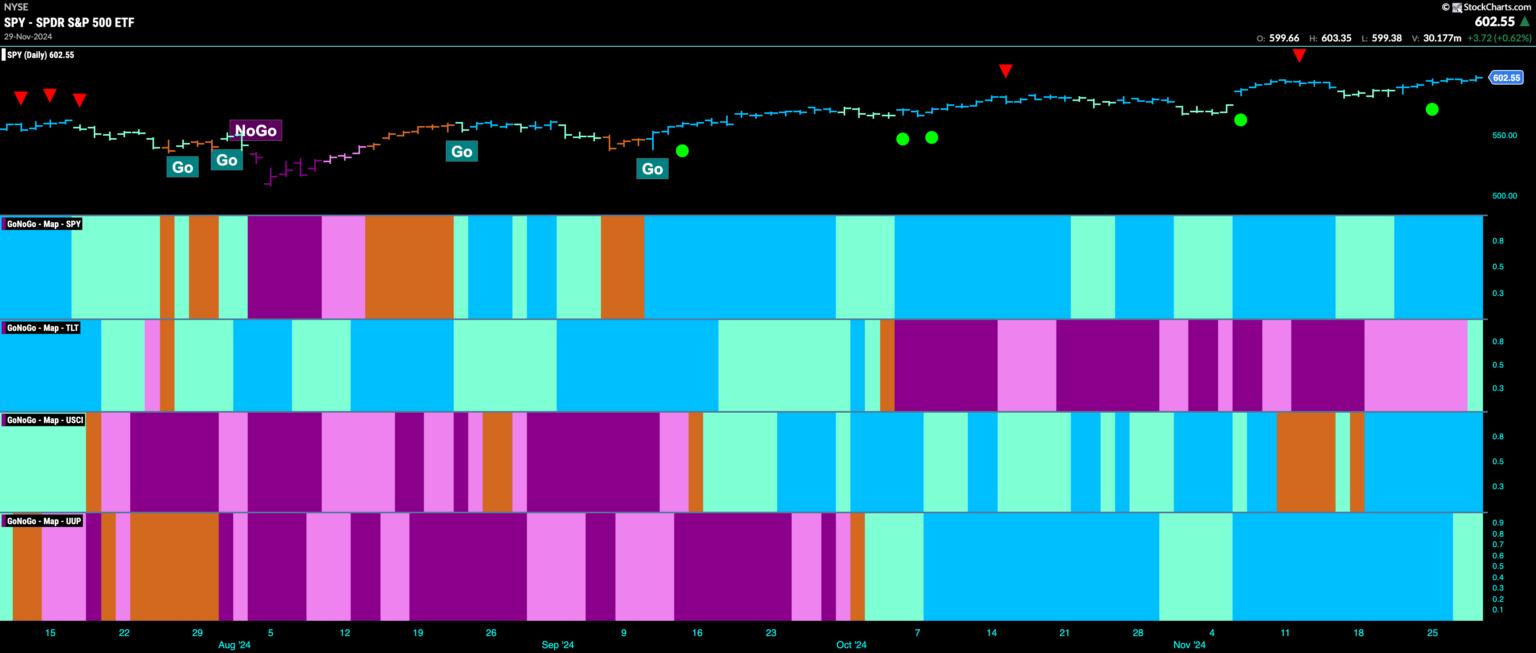

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities continues this week and we saw an uninterrupted week of strong blue bars. Treasury bond prices have seen a return to a “Go” trend with a pale aqua bar at the end of the week. U.S. commodities have shown strength with a string of bright blue “Go” bars. The dollar, which has been such a strong performer of late remained in a “Go” trend but demonstrated a little weakness with a couple of aqua bars.

$SPY Sees Continued Strength at New Highs

The GoNoGo chart below shows that price continued to rally this week and GoNoGo Trend painted a week of bright blue “Go” bars. Price has edged to new highs and we will look to see if it can consolidate at these levels. This came after GoNoGo Oscillator found support at the zero line on heavy volume. We know therefore that momentum is confirming trend direction. As long as momentum stays at or above zero we can say that the trend is healthy.

On the longer term chart, we can see that the trend is strong. We see a third consecutive strong blue bar as price creeps higher. GoNoGo Oscillator is in positive territory but not yet overbought. Perhaps there remains room to run. We will watch to see if the oscillator continues its upward trajectory or if it falls to test the zero line.

Treasury Rates Remain in Weak “Go” Trend

Treasury bond yields continue to fall and we saw a new lower low on pale aqua “Go” bars. This comes as GoNoGo Oscillator was unable to find support at the zero level. After breaking through that level into negative territory the oscillator quickly re-tested that level but was sharply rejected, falling quickly further into negative territory. Now, at a value of -3, momentum is negative but not oversold. We will watch to see if rates move lower from here.

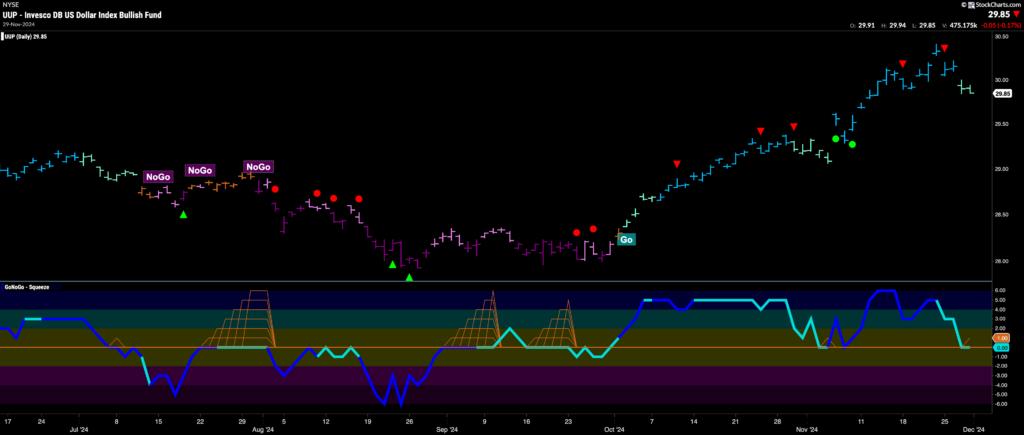

The Dollar Takes a Breather in “Go” Trend

After weeks of strong blue “Go” bars we saw some weakness creep in at the end of the week. This was not before another new higher high was hit however. After that high, a Go Countertrend Correction Icon (red arrow) told us that price may struggle to go higher in the short term and indeed as it fell from the high we saw weakness in the trend. GoNoGo Oscillator is at an inflection point as it tests the zero line from above. We will watch to see if it finds support at this level. If it does, then we can look for price to make an attempt at a new high.