Shifting Sands in the Top Five

At the end of last week, there were some interesting shifts in sector positioning, though the composition of the top five remained unchanged. Let’s dive into the details and see what the Relative Rotation Graphs (RRGs) tell us about the current market dynamics.

At the close of trading on Valentine’s Day (February 14th), we saw a bit of a love-hate relationship playing out among the sectors. Here’s how they stacked up:

- (3) Communication Services – (XLC)*

- (1) Consumer Discretionary – (XLY)*

- (2) Financials – (XLF)*

- (5) Technology – (XLK)*

- (4) Industrials – (XLI)*

- (6) Utilities – (XLU)

- (7) Consumer Staples – (XLP)

- (9) Real Estate – (XLRE)*

- (10) Energy – (XLE)*

- (8) Health Care – (XLV)*

- (11) Materials – (XLB)

Communication Services took the top spot from Consumer Discretionary, pushing that sector down to #2 and Financials down to #3. Technology and Industrials swapped places four and five.

We also saw some reshuffling in the bottom half of the ranking. Utilities (XLU) held steady, while Consumer Staples (XLP) maintained its #7 spot. Real Estate (XLRE) and Energy (XLE) each climbed a rung, landing at #8 and #9, respectively. Health Care (XLV) tumbled from #8 to #10, and Materials (XLB) remained firmly planted in the basement at #11.

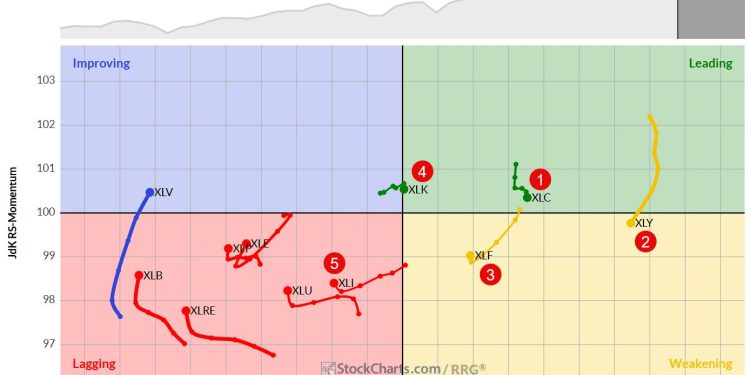

Weekly RRG: A Familiar Picture

The weekly RRG paints a similar picture to last week, with a few notable developments:

Consumer Discretionary still has the highest reading but is heading south inside the leading quadrant. Communication Services is losing some momentum but maintaining its relative strength. Despite being in the weakening quadrant, Financials has hooked back up—a positive sign. Technology is almost stationary, teetering on the edge of improving and leading.

Perhaps the most intriguing action is happening in the lagging quadrant, where most tails hook up slightly. While not all have achieved a positive heading yet, it’s a sign of potential improvement on the horizon.

Health Care is the lone wolf in the improving quadrant, a positive development. However, its low reading on the JdK RS-Ratio scale suggests it still has some work.

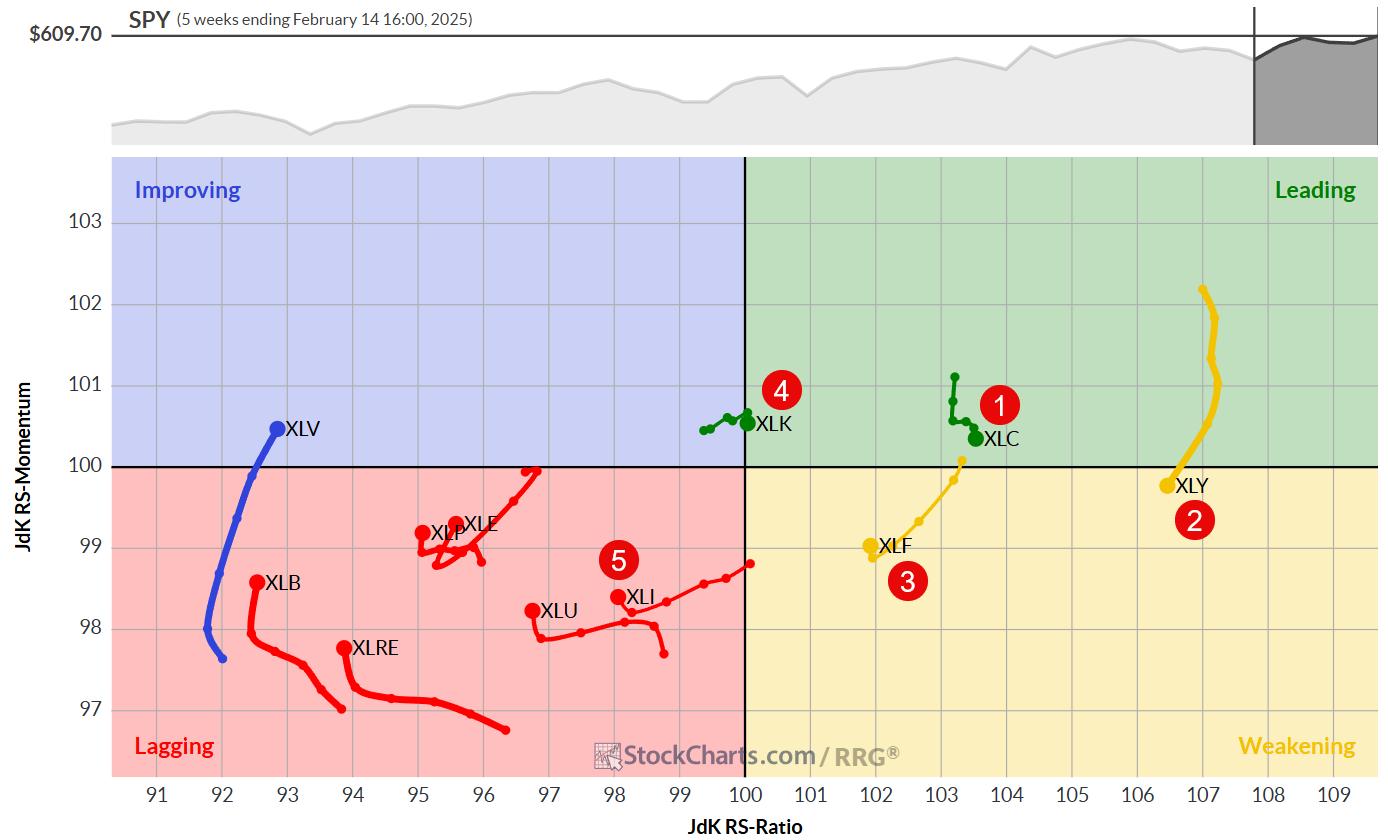

Daily RRG: Tech’s Time to Shine?

Switching gears to the daily RRG, we get a clearer picture of why some sectors are jockeying for position:

Technology flexes muscles with a strong, long tail in the improving quadrant.

Consumer Discretionary is heading in the opposite direction, moving into lagging territory.

Communication Services is holding onto its relative strength despite losing some momentum.

Financials, Health Care, and Materials are all in the lagging quadrant with negative headings.

Utilities are showing apparent strength, moving into the leading quadrant with gusto.

Spotlight on the Top Five

Let’s get into the trenches and examine each of our top performers:

Communication Services (XLC)

XLC is fulfilling expectations by emerging from its flag consolidation pattern and moving towards new all-time highs. It is also enhancing its standing on price and relative charts, which are bullish indicators of the sector’s ongoing supremacy.

Consumer Discretionary (XLY)

XLY is indicating some concerning trends. It has established a possible double top, which will be validated if the price falls below $218, the low from five weeks ago. The relative strength line mirrors this formation, and the RRG lines are declining. Considering its earlier strength, a notable decline may take a while to materialize, but it is certainly one to monitor closely.

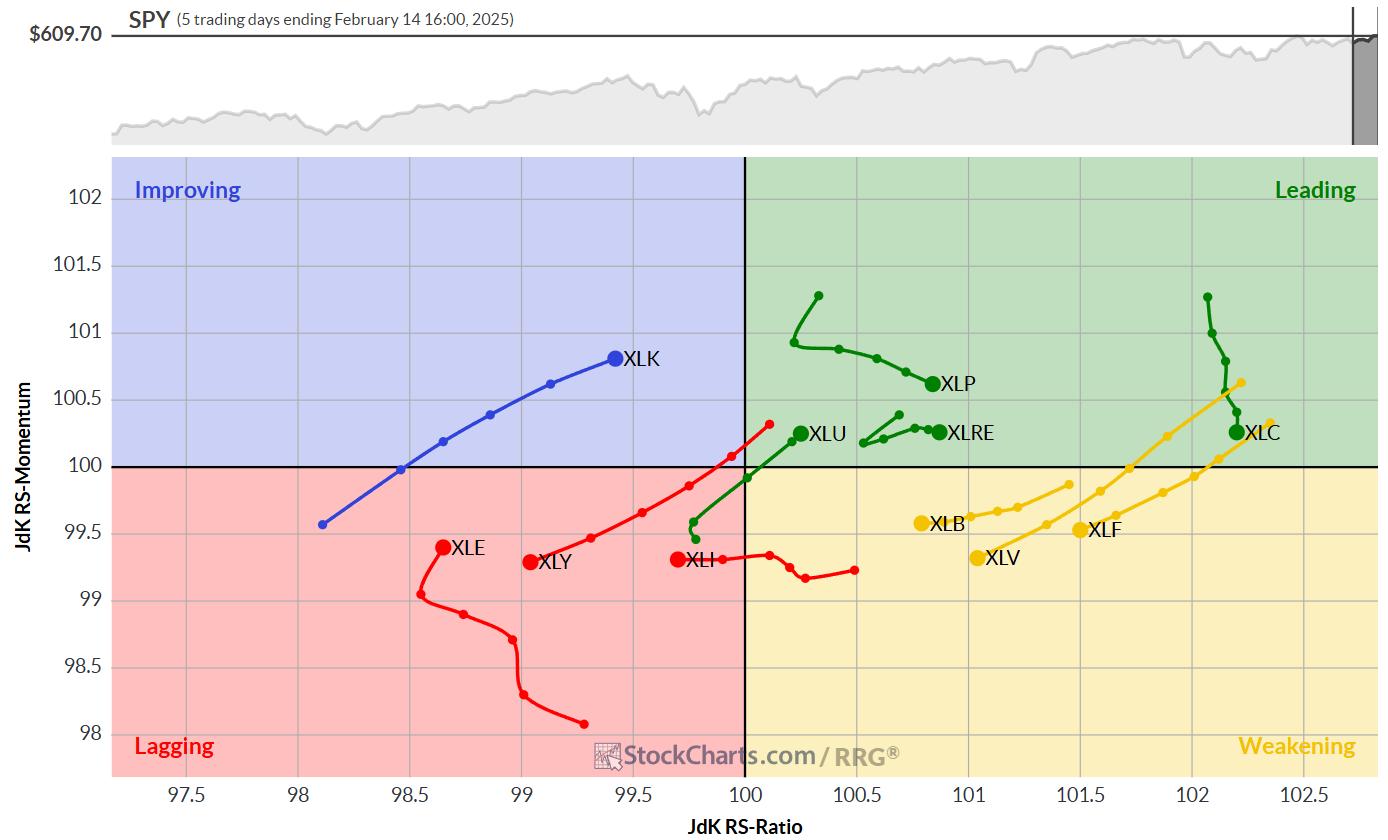

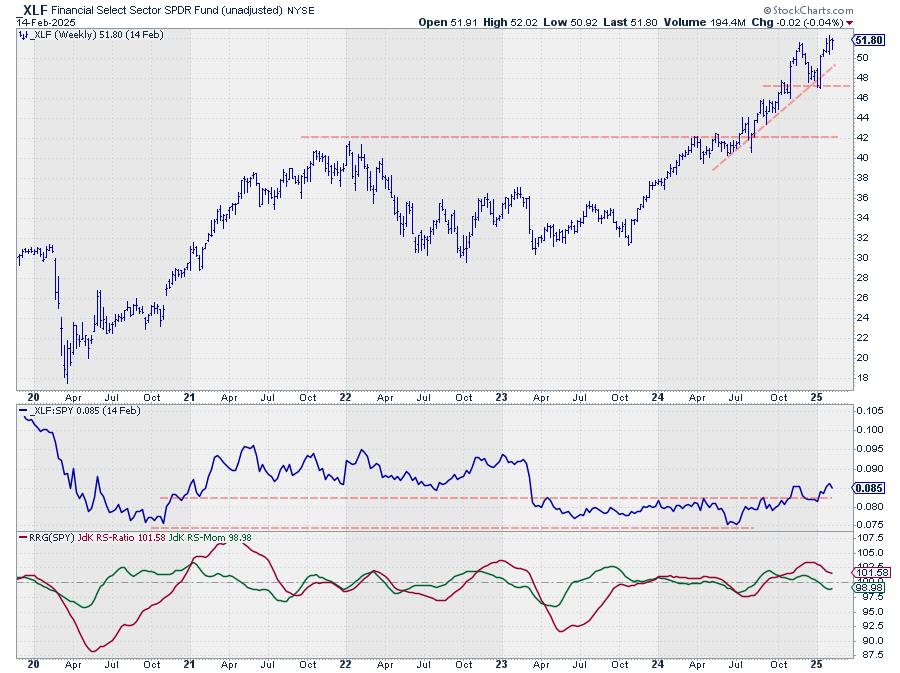

Financials (XLF)

Financials are holding their ground admirably. Last week saw a break above the previous high on a closing basis — something that didn’t happen in the two weeks prior. The raw RS line also pushes against (and possibly above) its previous high. If this improvement continues, expect Financials to maintain its top-five status.

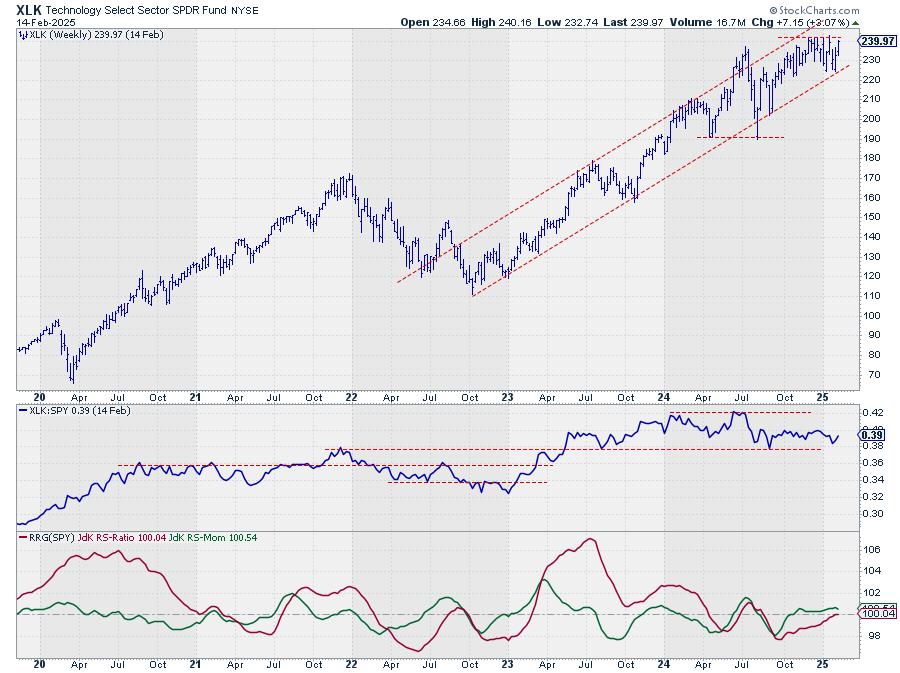

Technology (XLK)

Tech is making a comeback, overtaking Industrials for the #4 spot. Price-wise, we’re still grappling with overhead resistance around $242, but we closed at the week’s high — a positive sign. The relative strength is moving higher off the lower boundary, and RRG lines continue to climb (with a slight dip in momentum). I’m keeping a close eye on that $242 level — a break above could signal the start of a new leg up for the sector.

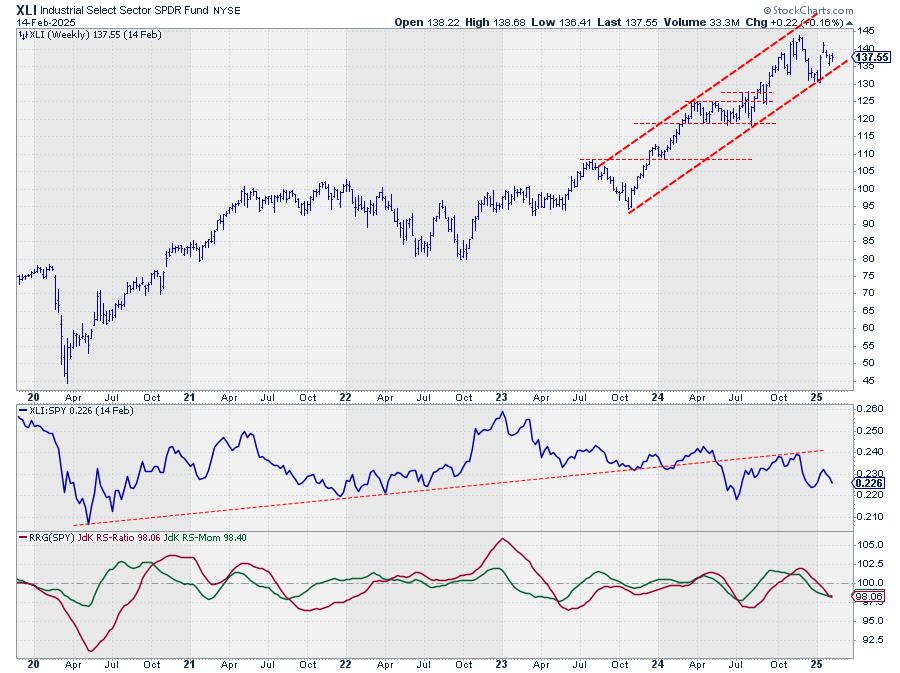

Industrials (XLI)

Industrials are living up to our expectations as the weakest link in the top five. It’s dropped from #4 to #5, thanks to continued weakness in relative strength. The RRG lines point lower, suggesting it’s only a matter of time before XLI drops out of the top five. Price-wise, we’re still within the rising channel, but a lower high has formed — not a great sign. Support comes in around $134 (rising support line) and $132-130 (late December low). A break below these levels could trigger a more significant decline.

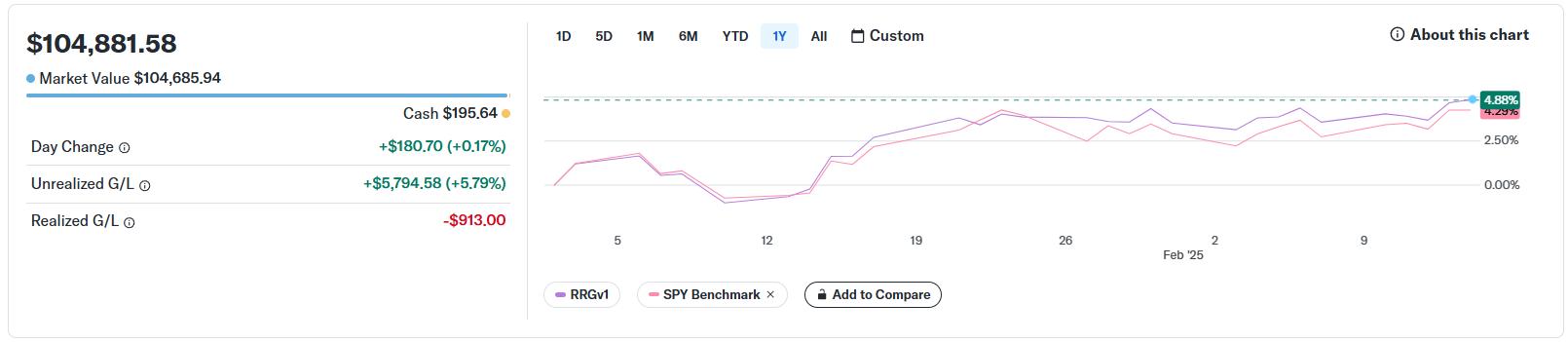

Portfolio Performance Update

Despite the changing conditions, our RRG portfolio remains robust. Since its inception, it has achieved a 4.88% gain, while the SPY benchmark has only increased by 4.29%, resulting in an outperformance of 59 basis points.

#StayAlert and enjoy your long weekend. –Julius