In my recent podcast interview with Jay Woods of Freedom Capital Markets, we discussed and debated the evolving landscape for equities and other risk assets. At this point, there has been enough of a rotation out of the Magnificent 7 stocks that investors are questioning where we could see new emerging leadership.

One of the big takeaways from my interview with Jay was to focus on areas of the market showing strong relative strength. And one of the key sectors we reviewed, which also happened to be the top performing S&P 500 sector this week, was the financial sector.

Today we’ll highlight three financial stocks showing strong relative strength thus far in 2025, and I should note that some of these charts were identified using the powerful scanning engine on StockCharts. If you’re trying to get more comfortable using scans, the new Sample Scan Library can be a fantastic place to start!

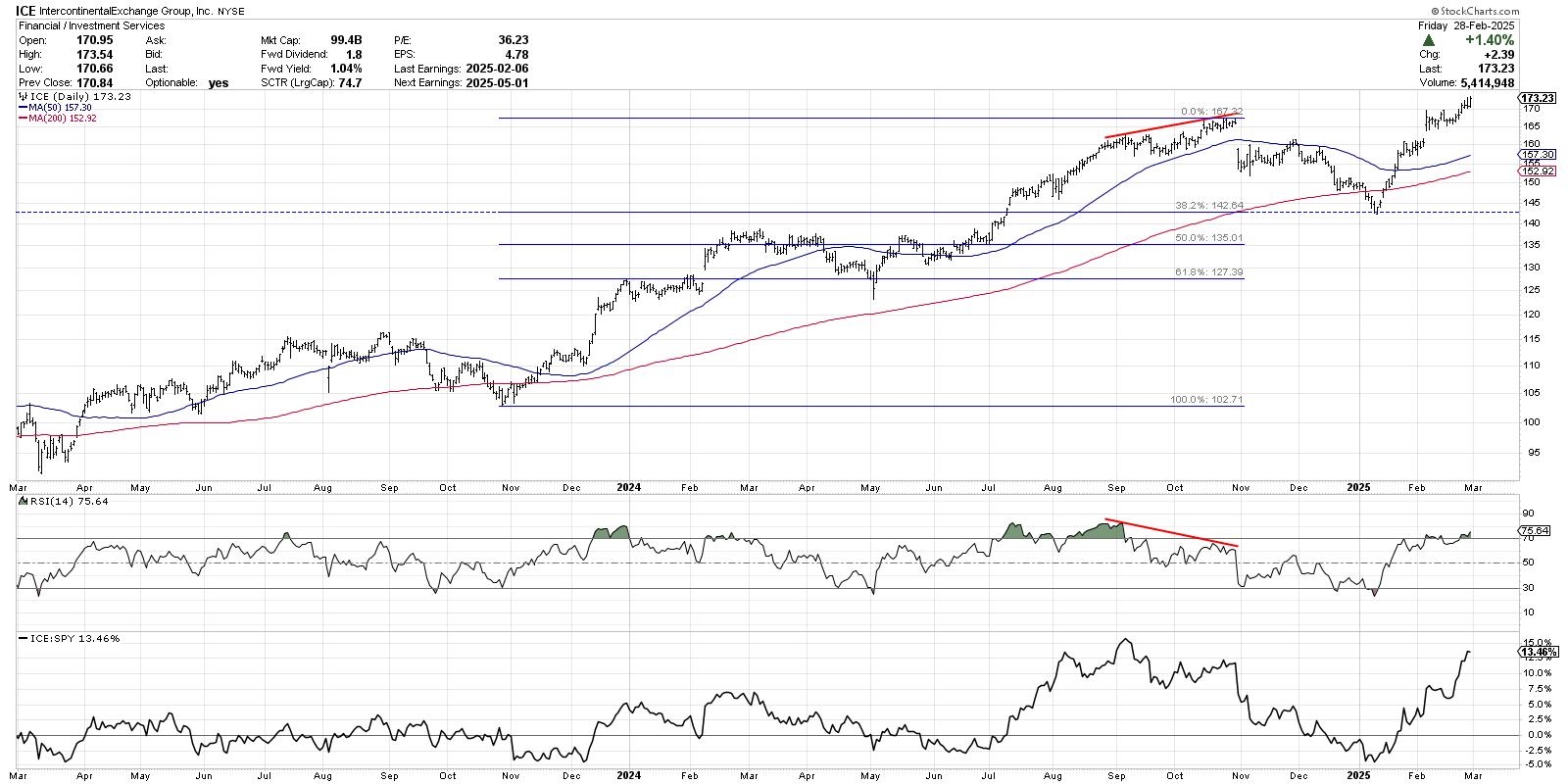

When the broad indexes start to falter, it can often be a great exercise to focus on stocks managing to pound out further new highs. While we often think of the financial sector as banks and regional banks, IntercontinentalExchange Group (ICE) is part of the exchanges subgroup and achieved a new all-time high again this week.

Looking for our daily market recap show? You can tune in for CHART THIS with David Keller, CMT every trading day at 5:00pm ET on our YouTube channel!

After a major low in October 2023 around $103, ICE spent the next 12 months in a primary uptrend formed by a consistent pattern of higher highs and higher lows. Note the bearish momentum divergence that occurred going into the late October high around $167, and how the subsequent pullback found support right at the 38.2% Fibonacci retracement of the previous uptrend phase.

Over the last six weeks, ICE has reversed course and now sits above two upward-sloping moving averages as it has once achieved a new all-time high. The bottom panel provides a fantastic reminder of the value of buying strong charts after they have pulled back to potential support levels, and also shows the impressive outperformance ICE has demonstrated in 2025.

The daily chart of Visa (V) features a cup and handle pattern for much of 2024, with a rounded bottom pattern ending with a brief pullback before a breakout above the “rim” of the cup. From that breakout around $290 in early November 2024, Visa has not looked back. This week, V achieved a new 52-week high, continuing a trend of outperformance that goes back to that November breakout.

Visa is a great example of what comprises a strong technical configuration. Price is making higher highs and higher lows, the two moving averages are both sloping higher, the RSI remains in a bullish range between 40 and 80, and the relative strength has been trending higher. As long as those features remain, the chart suggests further upside potential.

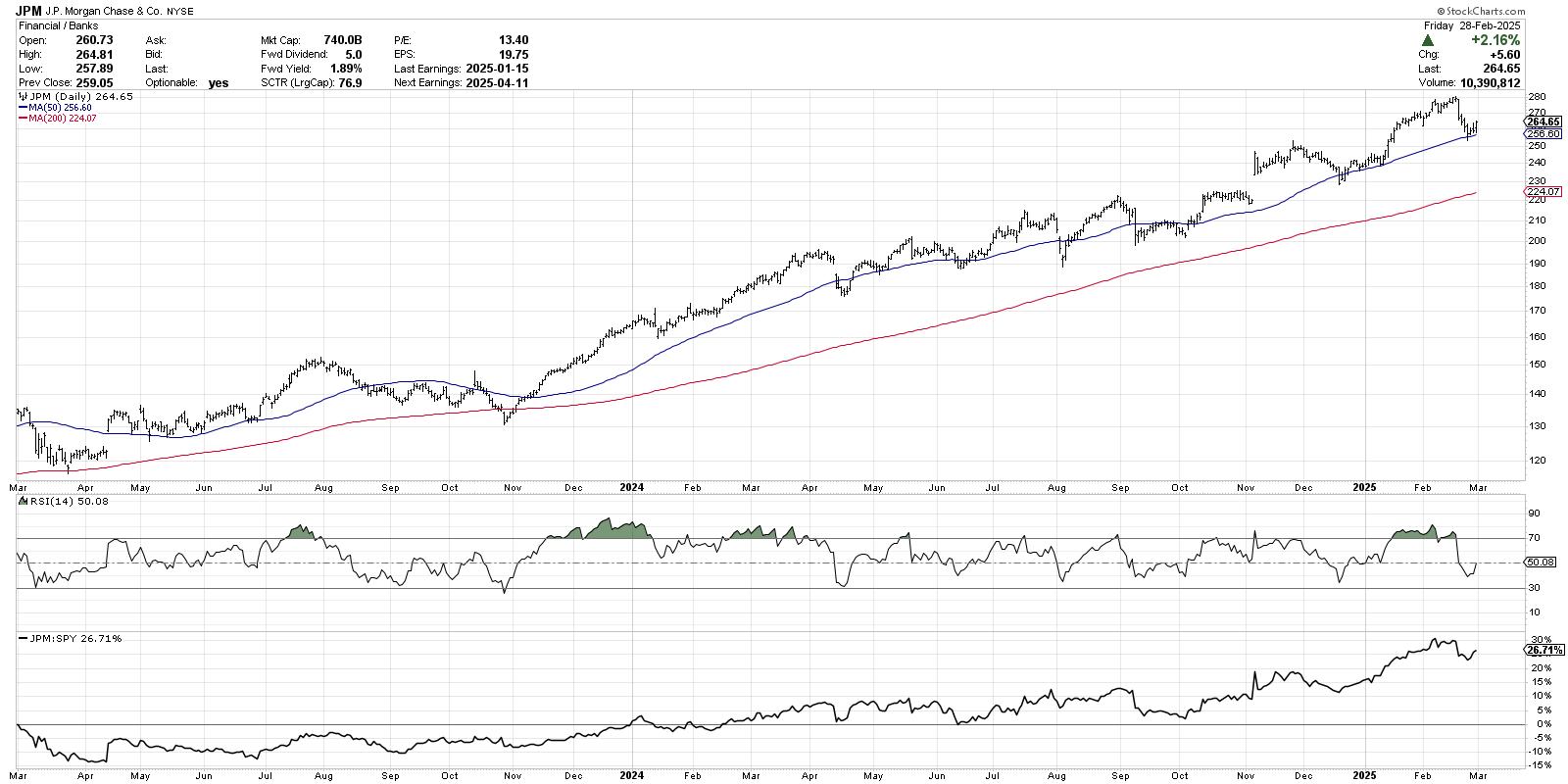

Not all financial names have been breaking out this week, with JPMorgan Chase (JPM) a great example of stocks that have pulled back even though the long-term trend remains strong. This week, JPM dropped to test its 50-day moving average, in a similar fashion to other pullbacks through the last 18 months.

Even with those frequent drawdowns, JPMorgan has sustained a bullish momentum configuration, with the RSI usually finding a low around 40 on price pullbacks. The relative strength has improved over the last six months, as JPM has managed to move higher while leading growth names have been struggling to hold key support levels.

One of the most common momentum factors measured by quantitative models is called the “12-1” factor, meaning the 12-month return minus the one-month return. So a stock that has experienced a strong 12 months but a weak one month would score the best. I would guess those momentum models are grading JPM quite well given the recent pullback and long-term bullish phase.

The best way I’ve found to weather periods of market uncertainty is to focus on relative strength, looking for stocks that are able to outperform their struggling benchmarks. These three stocks in the financial sector prove that there are charts out there with decent technical configurations, you just need to know where to look!

RR#6,

Dave

PS- Ready to upgrade your investment process? Check out my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research LLC

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.