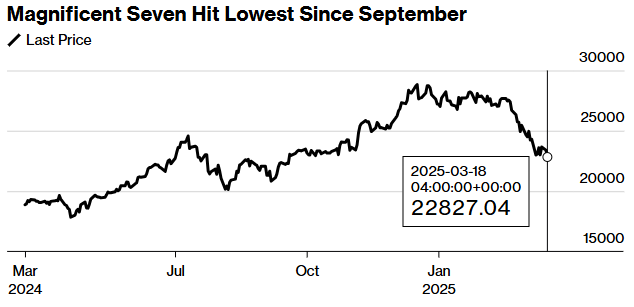

The sell-off in big tech stocks has deepened. The “Magnificent 7” stocks, which drove much of the US market rally over the past two years, are now dragging the major indices lower.

The group, which includes Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla, is on track for its worst quarter since late 2022.

The sharp reversal in these market leaders has raised questions about whether they are still too expensive or finally becoming attractive after months of declines.

A painful quarter for the giants

The Bloomberg Magnificent 7 Total Return Index is down 16% this year, slipping over 20% from its December highs.

At the same time, the tech-heavy Nasdaq 100 has dropped more than 12% from its peak and has officially entered correction territory. The index is now down 7.3% year-to-date.

Among the worst performers is Tesla, which has plunged 44% in 2025, while Alphabet, Apple, and Nvidia are each down over 14%.

Amazon and Microsoft are down 12% and 9% respectively. Even Meta, which was up as much as 26% earlier this year, is now slightly negative year-to-date, down 0.5%.

The weight of the Magnificent 7 on the S&P 500 cannot be overstated. Combined, these stocks account for roughly 30% of the index’s market capitalization, amplifying the impact of their declines.

Goldman Sachs recently revised its S&P 500 target to 6,200 from 6,500, citing the drag from big tech as a key reason.

More than half of the S&P 500’s losses this year can be traced back to the fall in these seven stocks.

Why the sell-off accelerated

Several factors have contributed to the sharp decline in valuations.

Growing fears of a slowing US economy and ongoing uncertainty around President Trump’s trade policies have weighed on sentiment.

Tech investors have also started to question whether the billions being poured into artificial intelligence will deliver the kind of returns needed to justify the sector’s lofty valuations.

Most of them have been actively reducing exposure to these large-cap tech names after two years of outperformance, rotating into broader market plays.

The equal-weighted S&P 500 is outperforming the market cap-weighted version by 4 percentage points year-to-date. All evidence points to the fact that selling pressure is concentrated in the largest names.

Cathie Wood’s Ark Innovation ETF recently sold Meta shares for the first time in nearly a year, which shows that even bullish investors are reassessing risk in the sector.

While Wood is rotating into names like Tesla and crypto-adjacent stocks such as Coinbase, the broader picture reflects how investors are moving away from large-cap tech following two years of outsized gains.

Analysts are also lowering the price targets of the Magnificent 7 stocks.

Valuations: Still rich or finally reasonable?

Despite the declines, valuations for the Magnificent 7 are mixed.

On average, the group still trades at 26 times expected earnings, according to Bloomberg.

That’s down from recent highs but still well above the lows of 2018 and 2022, when similar corrections took place. Back then, valuations fell to around 19 times forward earnings.

Some stocks in the group are still trading at elevated levels.

Tesla, for instance, remains expensive even after its steep fall, trading at 82 times expected earnings.

Apple trades at 29 times, while Alphabet, the cheapest in the group, trades at 18 times forward earnings, which is still higher than its 2022 low.

The market is divided. Some investors see the recent drop as a buying opportunity, while others warn that more downside is possible.

According to some analysts, for the broader market to rebound, the Magnificent 7 need to stabilize and participate. Without them, the weight of their market cap could keep indexes under pressure

Oversold or undervalued?

Beyond the headlines of falling stock prices, there are signs that valuations for parts of the group are beginning to reset to more compelling levels.

Google, Amazon, and Nvidia are now trading below their projected earnings growth rates.

This means their price-to-earnings-to-growth (PEG) ratios are below 1, a level typically seen as undervalued.

For large-cap tech giants, this is unusual and suggests that the market is discounting their future potential too heavily.

In simpler terms, these companies are priced as if they won’t deliver on their expected growth, despite strong fundamentals.

It’s rare for businesses of this size to have PEG ratios below 1, and it may indicate that at least part of the sell-off has been overdone.

Meta, Microsoft, and Apple are harder to judge.

Their valuations depend more heavily on future earnings revisions, and the current macro uncertainty makes those projections murky.

Tesla, meanwhile, stands apart. Its high valuation, low margins, and unique risks — including reliance on Elon Musk’s vision and leadership — make it the most volatile and speculative of the group.

The question investors now face is whether these tech giants are simply correcting after years of outperformance or if the market is starting to fundamentally reassess the growth and profitability assumptions behind these names.

While the long-term dominance of these companies is unlikely to vanish overnight, the recent sell-off suggests that markets are less willing to tolerate high valuations without concrete earnings delivery.

The post The big tech sell-off: are the ‘Magnificent 7’ stocks overvalued or oversold? appeared first on Invezz